Great news for those holding healthcare stock Akoya Biosciences (NASDAQ:AKYA). It recently made a hefty sale to one of its insiders and said insider isn’t just a one-off, either. The buy this time, though, was sufficiently large to let Akoya close up 20.4% in Tuesday’s trading.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The new insider buy came from Independent Director Matthew Winkler, who put down $1.02 million to pick up stock for an average price of $5 per share. This was the single largest insider buy that Akoya saw in the last 12 months, but it was far from the only one. Several insiders got together to buy a combined total of 383,390 shares in the last 12 months. Combined, that purchase was worth $1.9 million. However, investors sold close to a quarter of that total in the same time span, divesting 63,210 shares worth a combined $841,000.

Interestingly, Akoya Biosciences insiders only own 4.9% of the company. That’s considered a decent amount, though nothing especially noteworthy. The fact that the transactions have been largely recent—within the last 12 months—suggests that something may be going on behind the scenes. Either that or someone wants it to seem that way. A Simply Wall St. report, meanwhile, noted that Akoya isn’t forecast to become profitable at any point in the next three years. Plus, the company itself only has just under a year’s supply of cash left, and shareholders have seen dilution efforts previously.

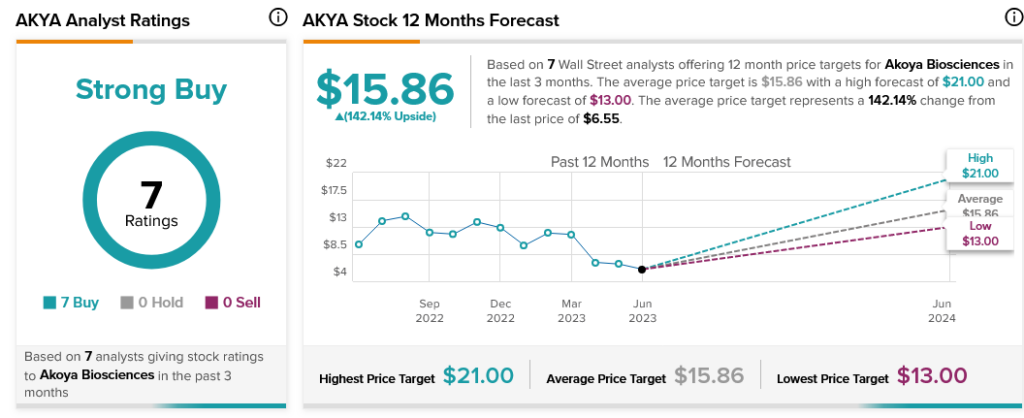

Analysts, however, aren’t especially concerned. Seven analysts declare Akoya Biosciences stock a Strong Buy by unanimous accord. Plus, with an average price target of $15.86, AKYA offers its investors 142.14% upside potential.