Airbus SE (EADSF) reported an 11% decline in deliveries for the first quarter of 2023. The European aerospace company said that it delivered 127 jets in Q1, down from 142 during the same period in 2022.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Out of the total deliveries, 116 were single-aisle aircraft, six A330 wide-body airliners, and five twin-engine jet airliners. Lower deliveries can be attributed to problems with the supply chain and hiring new employees that Airbus encountered during the quarter. In addition, the business disclosed that it has taken 156 orders so far in 2023.

Airbus may find it challenging to reach its goal of increasing global deliveries to 720 jets this year compared to 661 in 2022 due to the decline in deliveries. However, the company’s plans to expand production by adding a second A320 assembly line to its current Tianjin plant should help.

Is it Good to Buy Airbus Stock?

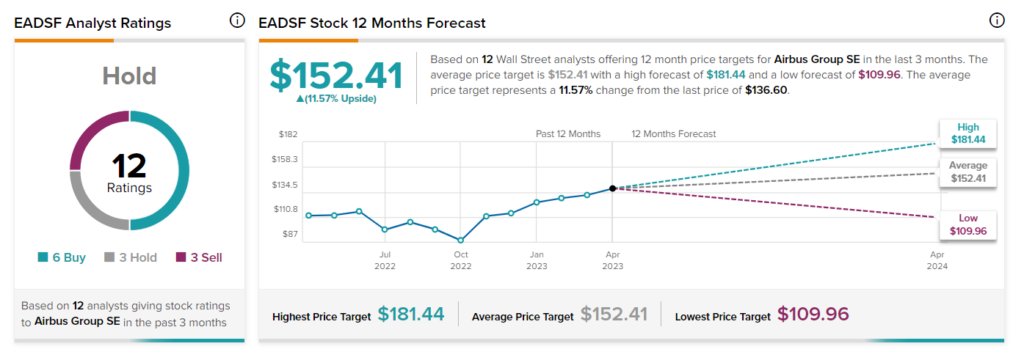

Airbus stock has received six Buy, three Hold, and three Sell recommendations for a Hold consensus rating. Moreover, analysts’ average price target of $152.41 implies an upside potential of 11.6%.