Airbnb’s (NASDAQ:ABNB) latest purchase definitely runs against type, but it might prove to be a surprisingly shrewd purchase. Investors are cheering, and pretty loudly, too, as Airbnb shares are up over 5% in Tuesday afternoon’s trading. So what was it that Airbnb bought that was so thoroughly unusual? An AI company. Airbnb, in its first-ever acquisition since it became publicly traded, dropped just under $200 million to buy Gameplanner.AI.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

If you haven’t heard of Gameplanner.AI, then don’t be alarmed; this particular AI startup has been running in “stealth mode” for the last three years. A firm in “stealth mode” is operating particularly quietly, usually in a bid to protect some bit of intellectual property, that Airbnb plans to incorporate into its own operations as a “travel concierge.” It will answer users’ questions and learn about their preferences to better connect them with destinations.

In a Shaky Economy, AI May Only be So Helpful

Brian Chesky, Airbnb’s CEO, looks for artificial intelligence to mean a lot more to Airbnb than to hotels, particularly in the short term. That’s mainly because Airbnb is mostly a digital product, while hotels are a physical product. That’s true in a lot of ways; after all, Airbnb exists mainly to connect travelers to properties, so it’s a safe bet that Airbnb will be able to take greater advantage of AI. However, the problem with that assessment is that we’re walking into a bad short-term market for travel in general. With inflation still massive and the economy looking shaky, AI may only be so helpful.

Is Airbnb a Buy or Sell?

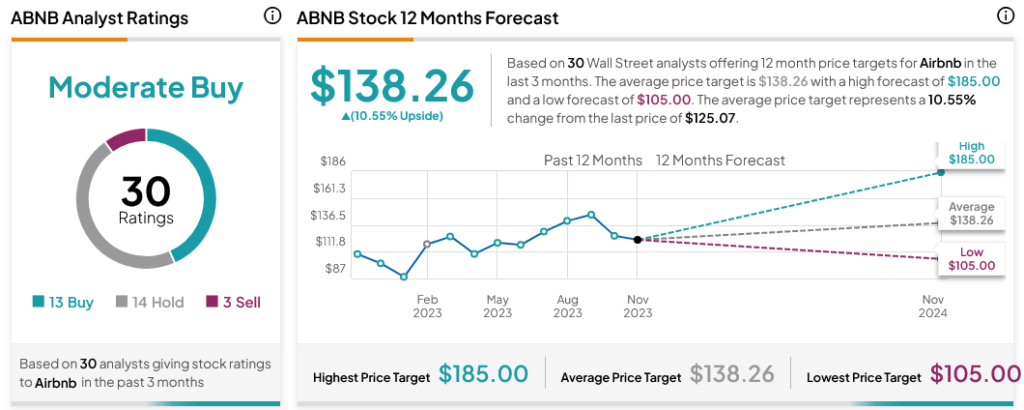

Turning to Wall Street, analysts have a Moderate Buy consensus rating on ABNB stock based on 13 Buys, 14 Holds, and three Sells assigned in the past three months, as indicated by the graphic below. After a 17.02% rally in its share price over the past year, the average ABNB price target of $138.26 per share implies 10.55% upside potential.