Airbnb (NASDAQ:ABNB) shares are trending higher today after the travel platform settled a case with the Italian Revenue Agency for an aggregate payment of 576 million euros (nearly $621 million).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The settlement came without any admission of liability on the part of Airbnb. Further, this resolution does not include any tax withholding assessments for 2022 and 2023. Airbnb noted that it does not plan to recover any tax withholdings from the impacted hosts for the audited periods.

Shares of the company have surged by nearly 19% over the past month as travel trends remained buoyant during the Thanksgiving period, and multiple airlines raised their financial outlooks.

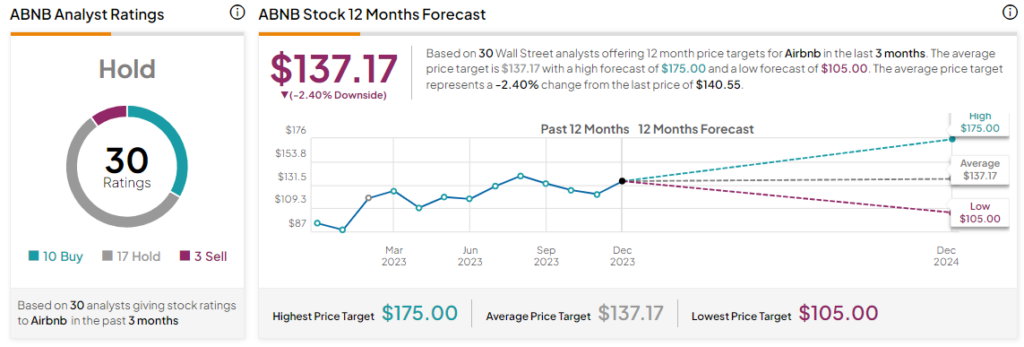

On Wall Street, BTIG analyst Jake Fuller reiterated a Hold rating on the stock without assigning any price target. Conversely, Barclays’ Ross Sandler has lowered his rating on Airbnb to a sell from a Hold. The analyst has a $100 price target on Airbnb.

What is the Price Target for Airbnb?

Overall, the Street has a Hold consensus rating on Airbnb. The average ABNB price target of $137.17 implies the stock may be hovering around fair valuation levels at present.

Read full Disclosure