TipRanks understands the value of expert guidance in this investment landscape. That’s why we offer the Top Hedge Fund Managers tool, which enables users to closely monitor the investment choices of leading financial minds. The tool uses data from Form 13-Fs to offer hedge fund signals. Interestingly, these experts are currently bullish on Airbnb (NASDAQ:ABNB) stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

ABNB provides an online marketplace that connects people looking to rent out their homes with those seeking accommodations.

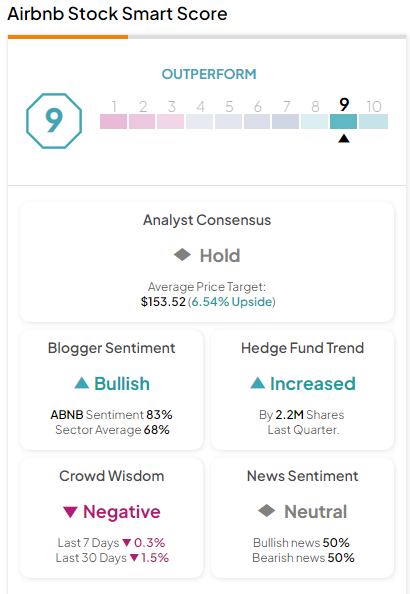

The Hedge Fund signal remains Very Positive for Airbnb stock. TipRanks data shows that hedge funds bought 2.2 million shares of the company last quarter, with Bridgewater Associates’ Ray Dalio and Intermede Investment Partners’ Barry Dargan increasing their holdings in ABNB stock.

Top Analyst Bullish on ABNB Stock

On May 15, Top-rated analyst John Staszak from Argus Research maintained a Buy rating on Airbnb stock with a price target of $170 (18% upside). Investors should note that Staszak ranks among the top 1% of Street stock experts. (To watch Staszak’s track record, click here.)

Staszak expects strong demand for Airbnb rentals in the U.S. and solid booking growth in Latin America and Asia Pacific markets. Buoyed by these expectations, he raised the company’s Fiscal 2024 earnings per share estimate to $4.64 from $4.57.

Is Airbnb Stock Worth Investing In?

Airbnb stock is up about 12% over the past six months. The company’s efforts to introduce new features and plans to integrate artificial intelligence (AI) into its platform to boost the booking experience are encouraging. However, a macroeconomic slowdown and intensifying competition remain key concerns.

Overall, the stock has a Hold consensus rating with nine Buy, 23 Hold, and five Sell recommendations. Analysts’ average price target on ABNB stock of $153.52 implies 6.54% upside potential.

Importantly, the stock has an Outperform Smart Score of nine on TipRanks. This indicates that ABNB has the potential to beat the market.

Concluding Thoughts

Airbnb remains well poised to expand into new verticals and increase market share in experiences and other travel-related services. However, increased marketing spending and intensifying competition may dampen profitability to some extent.

In the meantime, investors can use TipRanks’ Expert Center tools to make informed investment decisions.