Airbnb (ABNB) is set to report its third-quarter earnings today after the market closes, and options traders are pricing in a 7.95% move in either direction. This large swing reflects high expectations about the travel platform’s performance amid a competitive landscape. Also, the implied move is larger than ABNB’s three-year average post-earnings decline of -3.17%.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Wall Street is expecting ABNB to report Q3 earnings of $2.31 per share, compared with $2.13 in the same period last year. Also, analysts project revenues of $4.08 billion, up from $3.73 billion in the year-ago quarter.

Airbnb’s previous quarter also showed strong momentum, with revenue and earnings up 12.7% and 19.8%, respectively. The company also reported 134.4 million nights booked, up 7.4% year over year.

What to Watch in Today’s Report

At the upcoming earnings report, investors are looking for clues about Airbnb’s ability to navigate rising competition, regulatory challenges, and shifting consumer behavior. With the stock down about 8.5% year-to-date and lagging broader market indices, some investors are worried about whether the company can maintain its competitive edge.

In addition, key areas in focus today include gross booking value (GBV) trends, the number of nights and experiences booked, forward-looking guidance for Q4 and Fiscal 2025, and any updates on new product initiatives or geographic expansion.

These metrics will give insight into Airbnb’s growth strategy and its ability to adapt in a changing travel demand scenario.

Is Airbnb a Buy or Sell?

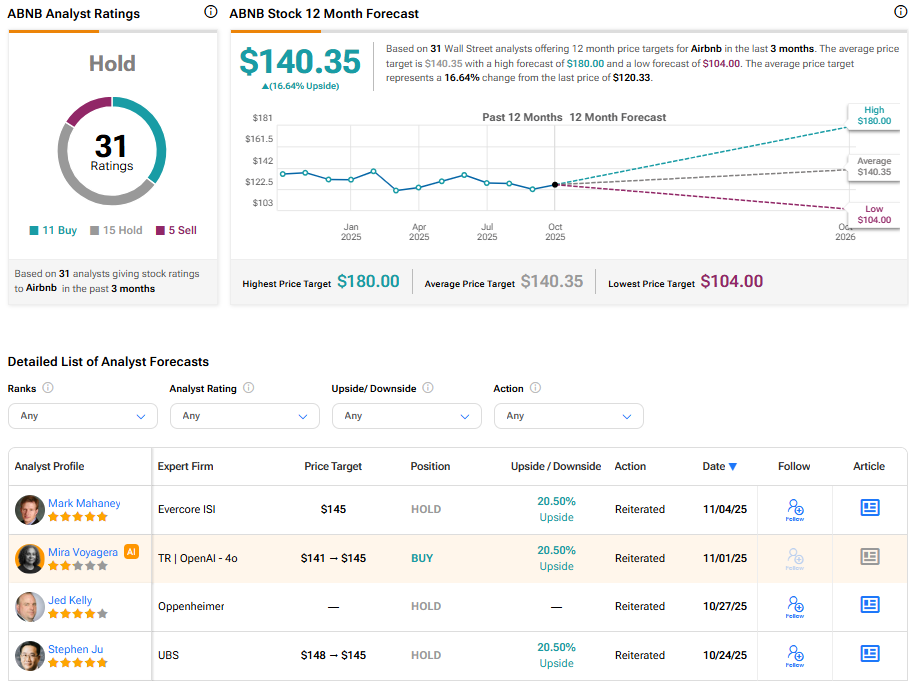

Turning to Wall Street, ABNB stock has a Hold consensus rating based on 11 Buys, 15 Holds, and five Sells assigned in the last three months. At $140.35, the average Airbnb stock price target implies a 16.64% upside potential.