Air Lease Corp. on Dec. 22 announced the delivery of one new long-term lease Airbus A320-200neo aircraft to Peach Aviation Ltd. (Japan). Shares declined 2.7% at the close on Tuesday.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Air Lease’s (AL) aircraft, featuring CFM International LEAP-1A engines, is the first of two new A320-200neo aircraft to be delivered this December from the company’s order book with the European planemaker.

Additionally, Peach is also expected to get two new leased A321-200neo aircraft delivered by Airbus in 2021 and 2022.

“This most recent transaction by ALC in the Japanese market demonstrates our commitment to environmental sustainability with the most modern, fuel-efficient aircraft,” said Air Lease Chairman Steven F. Udvar-Házy.

Separately, the aircraft leasing company also announced a long-term lease agreement for one new Airbus A321-200neo aircraft with Pegasus Airlines for delivery in 2023.

Pegasus Airlines also confirmed the sale of four Boeing 737-800 aircraft to Air Lease as part of a sale-leaseback transaction.

“This deal aligns with Pegasus Airlines’ fleet modernization and rationalization efforts to advance the airline’s environmental, financial and operational performance.” said Udvar-Házy.

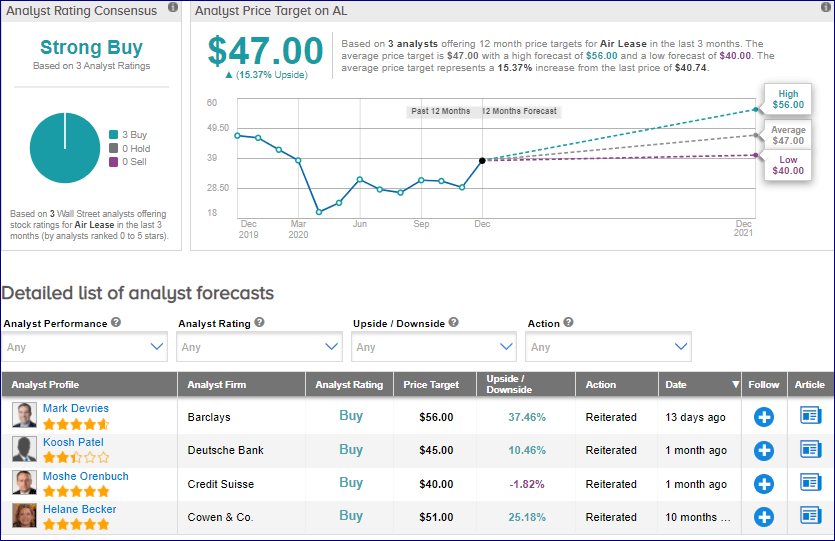

On Dec. 10, Barclays analyst Mark DeVries reiterated a Buy rating on AL stock and raised the price target from $44 to $56 (37.4% upside potential).

DeVries is “incrementally positive” on the stock citing the combination of promising Covid-19 vaccines, “healthy” consumers who’ve benefited from income replacement and loan forbearance, along with “still cheap valuations.” (See AL stock analysis on TipRanks).

From the rest of the Street, the stock scores a Strong Buy analyst consensus based on 3 unanimous Buys. The average price target of $47 implies upside potential of 15.4% to current levels.

Related News:

SQM Signs Long-Term Deal with LG Energy

Heico Surprises With 4Q Profit Beat; Cowen Sticks To Hold

Thor Industries Buys Tiffin Group For $300M; Street Remains Bullish