Air Canada’s (AC) stock is down 2% after the carrier lowered its 2025 guidance following a recent strike by its flight attendants.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The Montreal-based airline said the strike grounded more than 3,200 flights and wiped out $375 million in operating income. Air Canada had suspended its financial guidance due to the flight attendant strike. It has now reinstated its guidance, albeit at a lower level.

Management at Air Canada said they now expect full-year earnings of $2.9 billion to $3.1 billion, down from a previous forecast of $3.2 billion to $3.6 billion. The company says it expects third-quarter capacity to fall about 2% from a year ago, and projects operating income to come in at between $250 million and $300 million.

Labor Unrest

Labor unrest with the flight attendants hasn’t been completely resolved. Arbitration between Air Canada and the flight attendants’ union is underway, but a new contract has not yet been reached between the parties. Air Canada says no further service interruptions are anticipated while the arbitration process continues.

Analysts at Scotia Capital (BNS) wrote a positive note about Air Canada, stating: “The fact that AC resumed guidance even before finalizing the four-year collective agreement with the flight attendant union (CUPE) suggests to us that management is confident that the outcome of the pending wage arbitration process would be supportive of its assumptions.”

Is AC Stock a Buy?

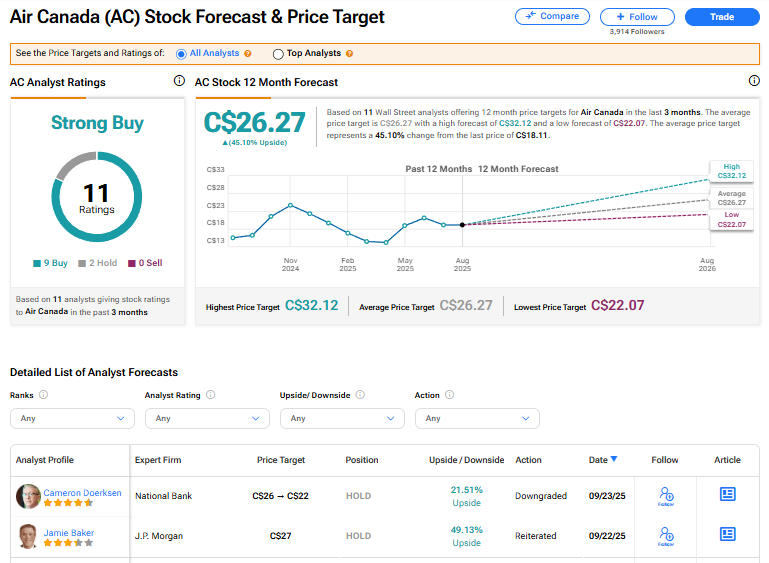

Air Canada’s stock has a consensus Strong Buy rating among 11 Wall Street analysts. That rating is based on nine Buy and two Hold recommendations issued in the last three months. The average AC price target of C$26.27 implies 45.10% upside from current levels.