Shares of artificial intelligence solutions provider C3.ai (NYSE:AI) are trending lower today after Wolfe Research’s Joshua Tilton downgraded the stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The analysts lowered the rating on AI to a Sell from a Hold alongside a $14 price target. This points to a 30.2% potential downside. Meanwhile, the consensus price target for AI stands at $21 pointing to a 4.7% potential upside.

The analyst sees potential risks for AI’s top-line growth owing to tight spending budgets amid a challenging macro backdrop. This could also pose a challenge to the company’s consumption business model.

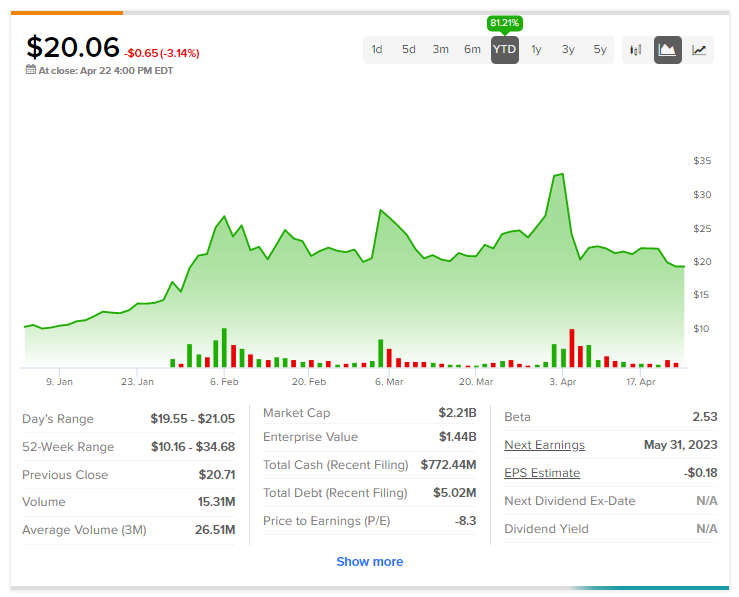

Shares of the company have been on a rollercoaster ride in recent times, rising from $11 at the beginning of 2023 to as high as $33.8 in the first week of April. The stock has seen a substantial correction since then but still remains nearly 81% up year-to-date. At the same time, short interest in AI remains sky-high at nearly 27.5% at present.

Read full Disclosure