It’s a catastrophe for enterprise software stock C3.ai (NASDAQ:AI), as a meeting with Deutsche Bank left the bank with all its concerns intact and its Sell rating still firmly in place. The move sent C3.ai on a slump that it has yet to recover from, down over 12% at one point in Friday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While certainly, Deutsche Bank’s refusal to budge on its Sell rating was a problem, there were bigger problems that contributed to C3.ai’s troubles. As detailed by Deutsche Bank analyst Brad Zelnick, C3.ai’s recent investor meeting event was less than satisfying. There were few details about any financial matters and the company’s operations in general. Investors—despite it being an investor meeting—didn’t actually show up. And while C3.ai detailed that it had some very strong activity with some of its customers, that wasn’t enough to keep Deutsche Bank’s concerns quiet.

It only gets worse from there. A Motley Fool report detailed that C3.ai is currently trading at a “hefty premium,” and the losses that it’s seen so far are “unsustainable.” However, there is some good news here, including the revelation that 34% of C3.ai’s total bookings are found among oil and gas stocks. And these companies are likely to produce a product in demand for decades to come. But that’s still not much relief among all the other downsides.

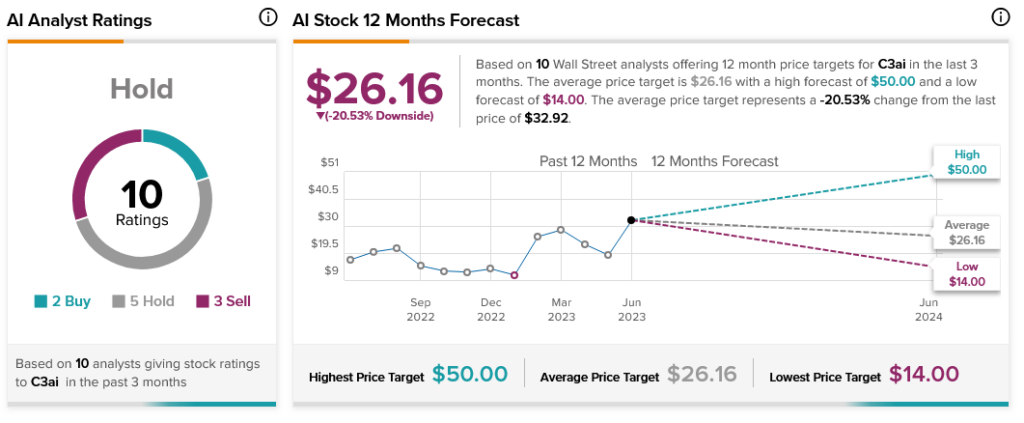

Meanwhile, analysts, in general, are largely split on C3.ai’s overall future. With two Buys, three Sells, and five Holds, analyst consensus currently calls C3.ai stock a Hold. In addition, with an average price target of $26.16, C3.ai stock also comes with 20.53% downside risk.