It is undeniable that tech giant Microsoft (MSFT) has been circling its collective wagons around artificial intelligence (AI) development, building up steam to be one of the biggest players in the sector. And new reports have emerged noting that CEO Satya Nadella has a plan going forward for “AI innovation,” which the reports expect will be the “…driver of Microsoft’s next phase of growth.” This outlook proved welcome for investors, who sent Microsoft shares up around 2% in Tuesday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Microsoft has been building out AI infrastructure, of course. It currently counts over 400 data centers to its credit, operating across 70 different regions across the globe. Its recently-opened Fairwater data center, meanwhile, is said to be the most powerful one on the planet right now. Throw in the rising investment that Microsoft is making in quantum computing and other platforms, and the picture sharpens further. The Azure AI Foundry is reportedly aggregating over 11,000 separate models.

Plus, Microsoft is dropping $4 billion over the next five years to promote AI skills development, infrastructure tools, and assorted philanthropic ventures to help ensure that AI reaches everywhere, and everyone gets a crack at the benefits therein. Of course, the potential drawbacks of AI are quietly unnoticed, but still.

Ad-Supported Cloud Gaming

Then, Microsoft offered up another revelation that represents a huge, if not exactly welcome, step forward. Microsoft is currently testing a free Xbox cloud gaming plan that includes ad support. Test phases are likely to start up soon, reports note, and open up access to the cloud gaming platform in exchange for advertising viewership.

The current ratio—and this may change before release—stands at around two minutes of ads before a game can be streamed for free, with one hour per session, and as many as five free hours a month. While this plan would work for some titles, it would not necessarily work so well for, say, a role-playing game or the like.

Is Microsoft a Buy, Hold or Sell?

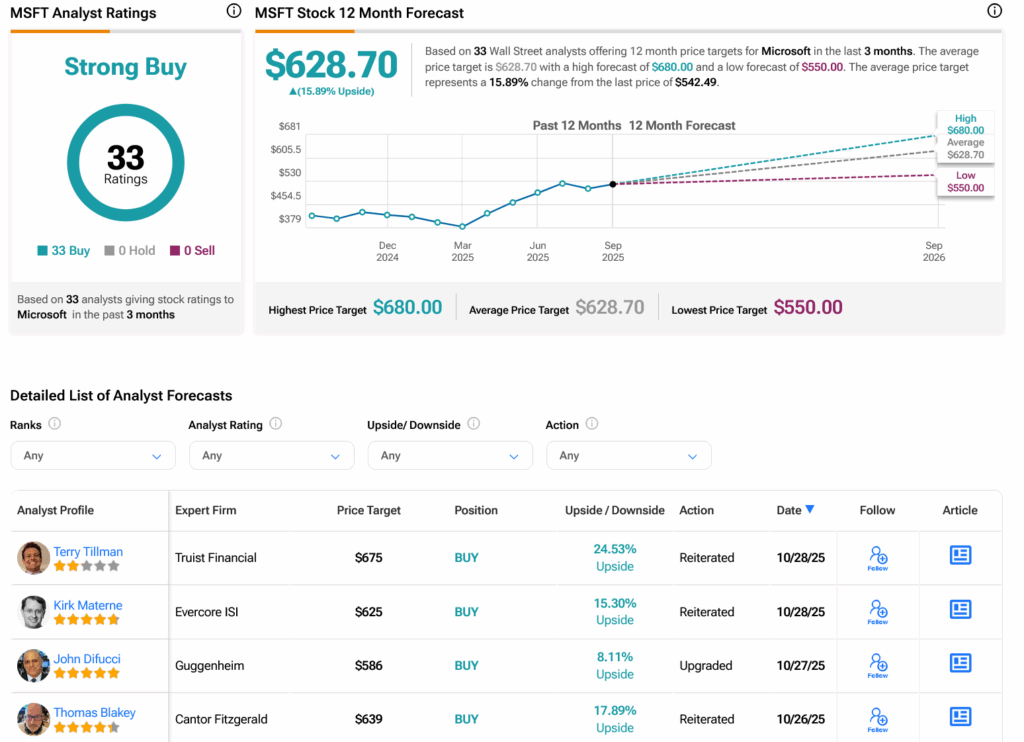

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSFT stock based on 33 Buys assigned in the past three months, as indicated by the graphic below. After a 23.05% rally in its share price over the past year, the average MSFT price target of $628.70 per share implies 15.89% upside potential.