Shares of BigBear.ai (BBAI) have soared more than 200% over the past year, fueled by excitement around its AI-driven data analysis platform. However, the stock has dropped more than 20% in the past five trading days amid a broader market sell-off and fears of an AI bubble. Notably, TipRanks’ A.I. analysis also cautions investors due to uncertainties around profitability and valuation.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Meanwhile, BigBear.ai is scheduled to release its Q3 2025 results on November 10. Analysts expect a loss per share of $0.07, slightly wider than last year’s $0.05 loss. Moreover, revenue is projected to fall 23% year-over-year to $31.8 million.

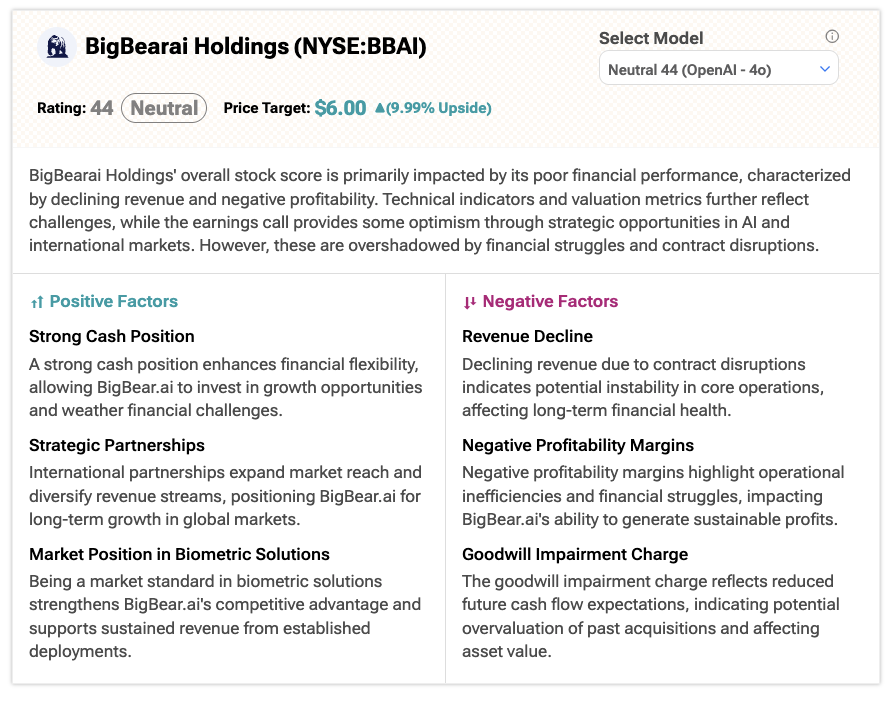

BBAI Earns Neutral Rating from AI Analyst

For context, TipRanks’ A.I. Stock Analysis delivers automated, data-driven evaluations of stocks, giving investors a clear and concise snapshot of a stock’s potential. Moreover, TipRanks’ A.I.-driven rating combines insights from multiple models, including OpenAI’s (PC:OPAIQ) GPT-4o and Perplexity’s SonarPro.

According to TipRanks A.I., BBAI stock scores 44 out of 100 based on the OpenAI model. It also assigns a price target of $6, suggesting an upside of about 10% from current levels.

What Went Wrong with BigBear.ai?

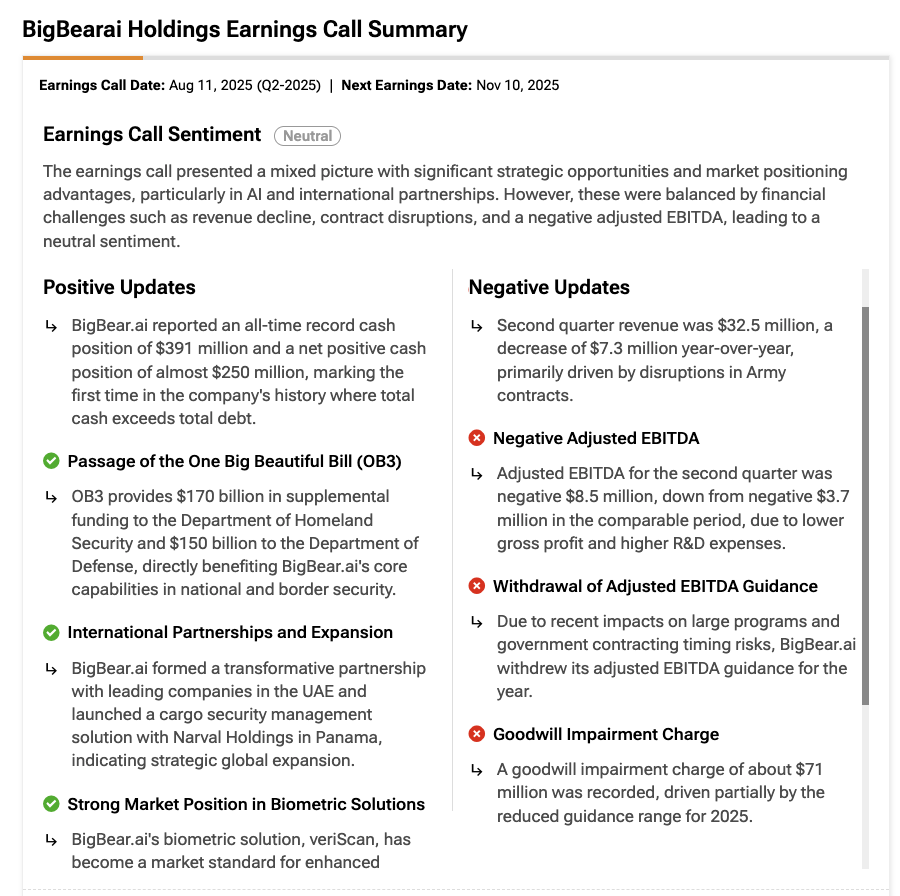

BigBear.ai Holdings’ overall stock score is weighed down by weak financial performance. The company faced a challenging second quarter, with revenue down 18% year-over-year and a sharp rise in net losses. It also missed analysts’ estimates and lowered its full-year adjusted EBITDA guidance and revenue outlook, citing disruptions in federal contracts.

According to TipRanks A.I. stock analysis, BBAI Q2 earnings call sentiment is Neutral.

With Q3 around the corner, investors will be looking to see if BigBear.ai can recover its government contracts and stabilize revenue. Better margins or new contracts could boost investors’ confidence, while another weak quarter might deepen concerns about the company’s profitability.

AI Analyst Spotlights Positives and Negatives for Investors

The tool also highlights both the positive and negative factors influencing the company’s stock performance.

According to A.I. analysis, BigBear.ai benefits from a strong cash position, giving it the flexibility to invest in growth, manage debt, and weather economic downturns. For context, BigBear.ai reported a record cash balance of $391 million as of June 30, 2025. Strategic international partnerships and new solutions also position the company for potential global expansion.

However, the company faces challenges that could affect its stock. Falling revenue from contract problems show instability in its income, and negative adjusted EBITDA indicates difficulties in running the business profitably. Below is a screenshot for reference.

Is BBAI a Good Stock to Buy?

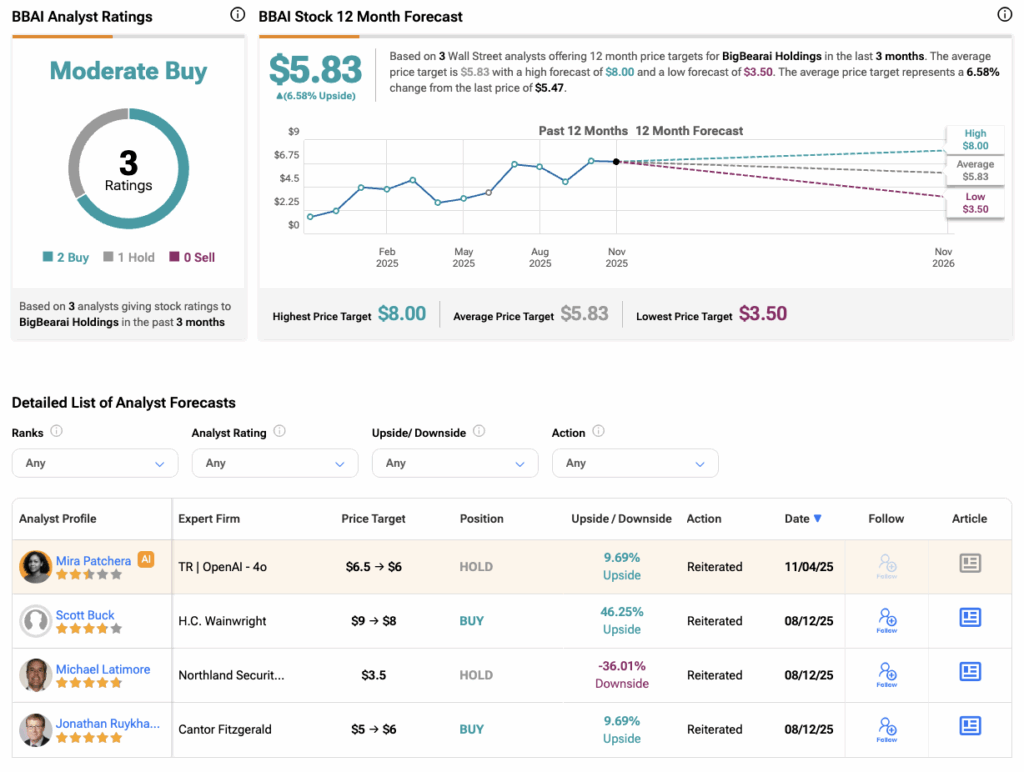

On TipRanks, analysts have a Moderate Buy consensus rating on BBAI stock, based on two Buys and one Hold assigned in the last three months. The average BigBear.ai share price target is $5.83, which implies an upside of 6.58% from current levels.