Costco (COST) wrapped up its FY25 with a strong quarter that slightly beat expectations, underscoring its competitive strengths. However, TipRanks’ A.I. Stock Analysis urges caution, pointing to questions about valuation and bearish technical indicators. Meanwhile, traditional Wall Street analysts have a moderately bullish outlook on COST stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For context, TipRanks’ A.I. Stock Analysis delivers automated, data-driven evaluations of stocks based on key performance metrics, giving investors a clear and concise snapshot of a stock’s potential.

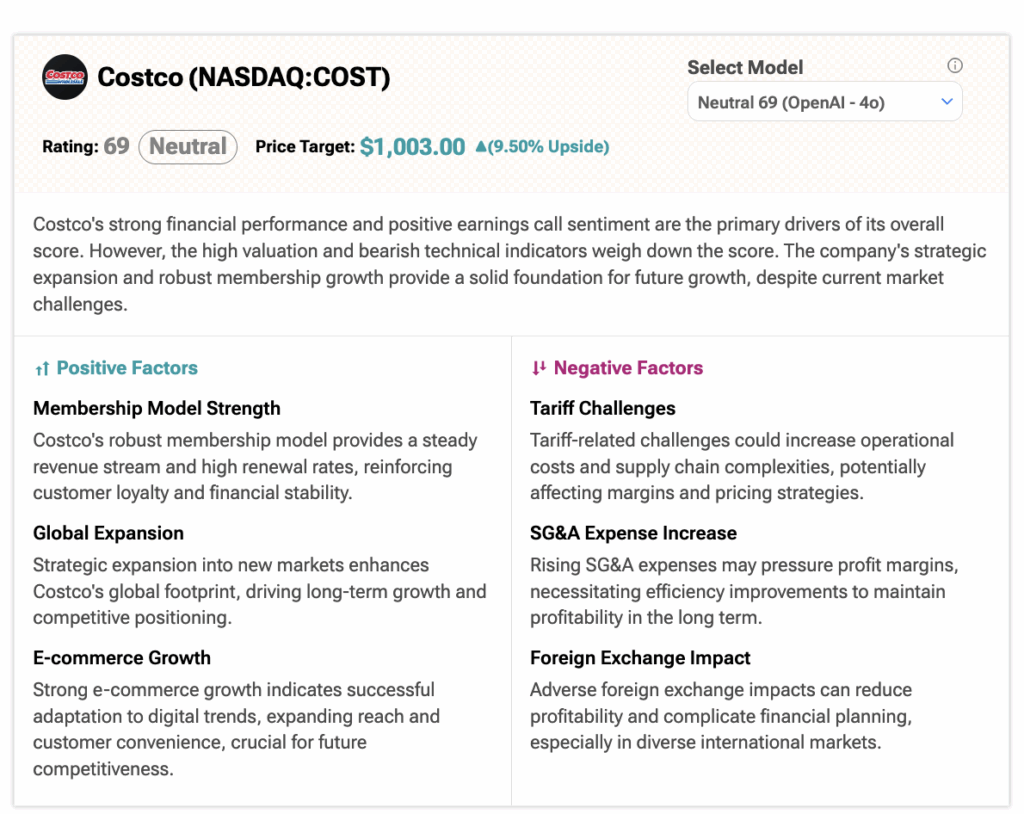

COST Stock Earns a Neutral Rating

According to TipRanks’ A.I. Stock Analysis, COST stock earns a Neutral rating with a score of 69 out of 100. Meanwhile, it sets a price target of $1,003.0, which implies an upside of 9.5% from current levels.

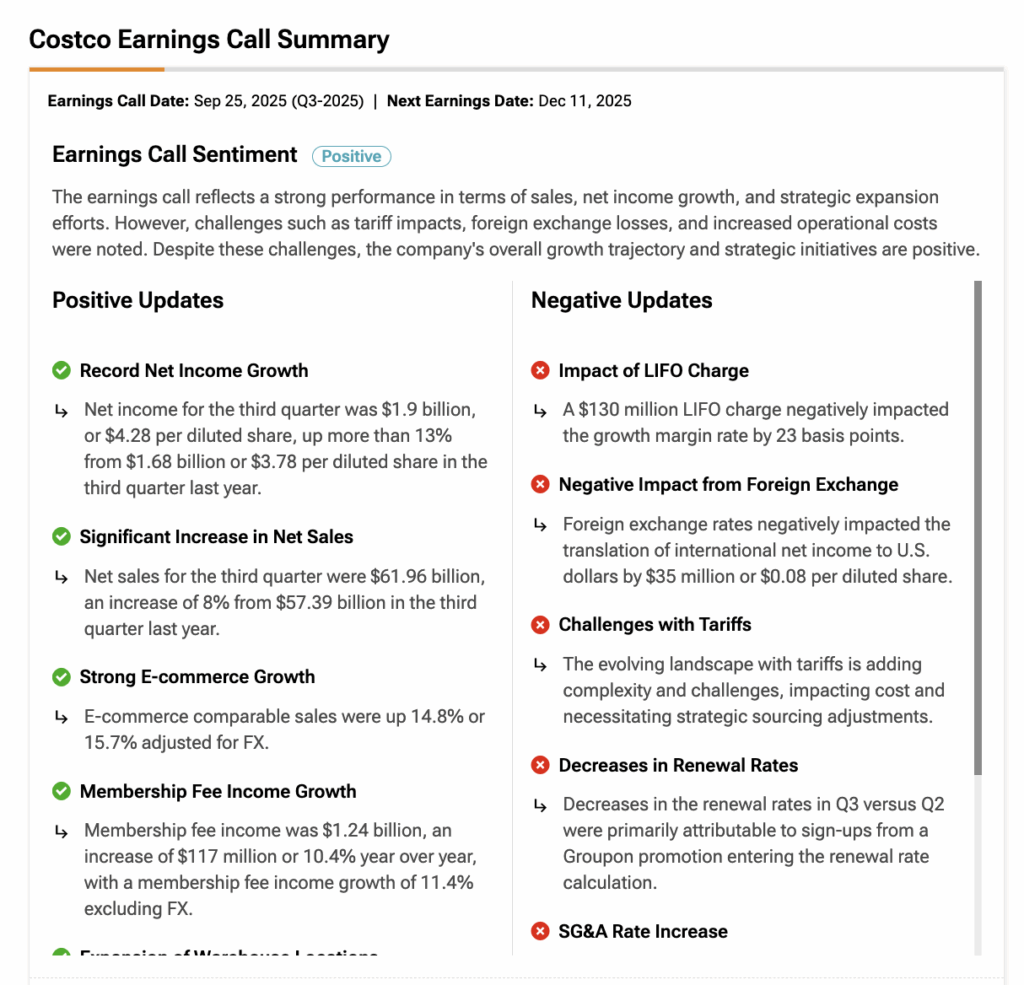

Overall, Costco’s strong score reflects its latest results. Last week, the company reported fiscal fourth-quarter earnings that topped analyst forecasts for both EPS and revenue. TipRanks A.I. Stock Analysis flagged the earnings call sentiment as positive, citing record net income growth, robust e-commerce sales, and ongoing warehouse expansion. However, it also noted challenges such as tariff impacts, foreign-exchange losses, and rising operational costs.

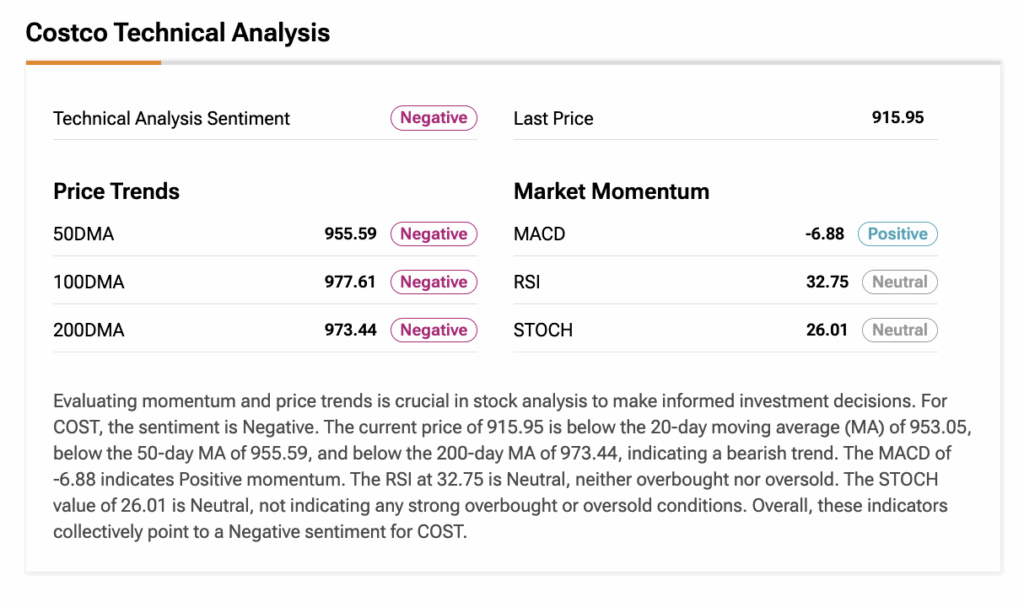

On the other hand, a rich valuation and weak technical signals weigh on the stock’s outlook. Notably, COST’s P/E ratio stands around 50, compared to the sector average of 21.55.

The tool also noted that the company’s strategic expansion and steady membership growth give it a solid base for long-term growth despite today’s market headwinds.

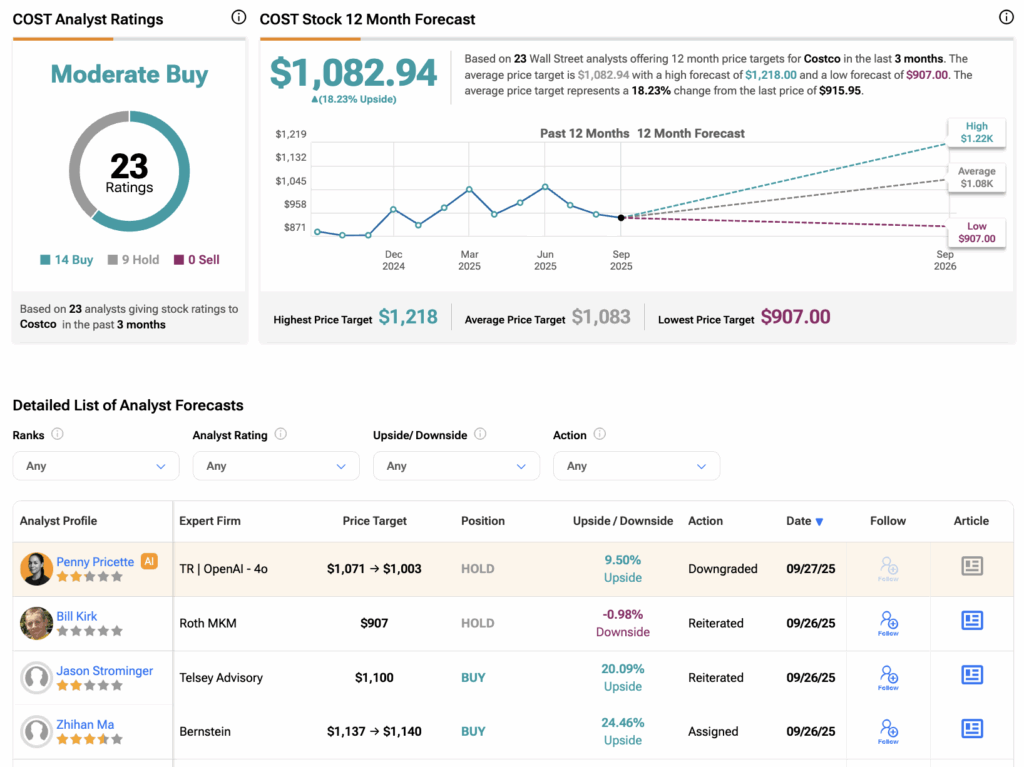

Wall Street Stays Moderately Bullish on COST

After last week’s earnings report, COST stock received mixed reactions from Wall Street analysts.

Bernstein analyst Zhihan Ma reiterated a Buy rating, pointing to Costco’s powerful membership model, growth opportunities overseas, and a strong domestic base. Similarly, Morgan Stanley’s four-star-rated analyst Simeon Gutman kept a Buy rating, though he trimmed his price target to $1,130. Gutman noted a slight dip in renewal rates but said overall membership growth remains healthy, helped by tier upgrades and a larger customer base.

Meanwhile, Citi analyst Steven Zaccone maintained a Hold rating, pointing out that Costco’s premium valuation leaves little room for error as it heads into tougher year-over-year comparisons. The four-star-rated analyst also warned of challenges like persistent inflation and cautious consumer spending, which could hurt discretionary sales.

Is COST Stock a Good Buy?

Overall, Wall Street analysts have a Moderate Buy consensus rating on COST stock based on 14 Buys and nine Holds assigned in the last three months. The average stock price target of Costco is $1,082.94 implying an upside of 18.23% from the current trading level.