Artificial Intelligence (AI)-enabled cloud computing company CoreWeave (CRWV) is scheduled to announce its third-quarter results on November 10. Despite the pullback in shares due to the termination of the company’s proposed takeover of Core Scientific (CORZ) and broader concerns about the lofty valuation of AI plays, CRWV stock is still up 168% from its IPO (initial public offering) price of $40. Although concerns about high debt and customer concentration risks remain, several analysts are bullish on CoreWeave’s growth prospects due to robust demand for its Nvidia (NVDA) GPU-based cloud platform that is well-suited for AI workloads.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Meanwhile, Wall Street expects CoreWeave to report a loss per share of $0.40 on revenue of $1.29 billion. In Q2 2025, revenue grew 207% year-over-year to $1.2 billion. However, CoreWeave reported a larger-than-anticipated loss of $0.27 per share. Nonetheless, CRWV ended the second quarter with a solid backlog of $30.1 billion.

Interestingly, ahead of the Q3 results, CoreWeave and AI startup Vast Data announced a $1.17 billion commercial agreement, extending their existing partnership amid growing demand for AI infrastructure.

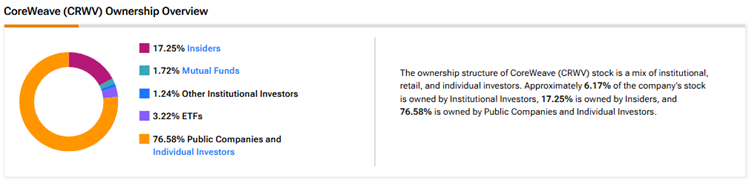

Now, according to TipRanks’ Ownership Tool, public companies and individual investors own 76.58% of CoreWeave. They are followed by insiders, ETFs, mutual funds, and other institutional investors at 17.25%, 3.22%, 1.72%, and 1.24%, respectively.

Digging Deeper into CRWV’s Ownership Structure

Looking closely at the top shareholders, CW Opportunity LLC owns the highest stake in CoreWeave at 7.77%, followed by Philippe Laffont with a 4.68% holding.

Among the top ETF holders, the Vanguard Extended Market ETF (VXF) owns a 0.62% stake in CoreWeave, while the Vanguard Growth ETF (VUG) owns 0.44%.

Moving to mutual funds, Vanguard Index Funds holds about 0.92% of CRWV. Meanwhile, J.P. Morgan Mutual Fund Investment Trust owns 0.26% of the company.

Is CRWV Stock a Good Buy?

Currently, Wall Street has a Moderate Buy consensus rating on CoreWeave stock based on 13 Buys, 11 Holds, and one Sell recommendation. The average CRWV stock price target of $156.87 indicates 46% upside potential from current levels.