Advanced Micro Devices (AMD) shares have soared nearly 97% year-to-date, driven by strength in its data center business and optimism over its expanding role in the AI chips market. Its new deals with OpenAI (PC:OPAIQ) and Oracle (ORCL) show strong demand for AMD’s chips from leading AI players. The company is set to report its Q3 2025 earnings on Tuesday, November 4. Wall Street expects AMD to report earnings of $1.17 per share for Q3, up 27% from the year-ago quarter.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Meanwhile, analysts project Q3 revenues at $8.75 billion, up 28% year-over-year. Ahead of the Q3 results, several analysts have raised their price targets and reaffirmed their Buy ratings on AMD stock, calling the chipmaker one of the strongest beneficiaries of the growing AI infrastructure boom. With earnings on the horizon, it’s worth taking a closer look at who owns AMD stock.

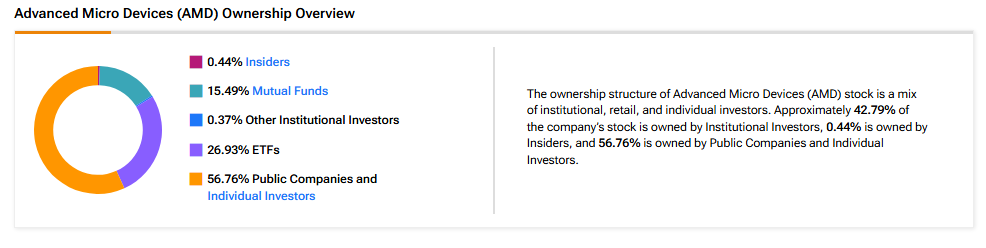

Now, according to TipRanks’ ownership page, public companies and individual investors own 56.76% of AMD. They are followed by ETFs, mutual funds, other institutional investors, and insiders at 26.93%, 15.49%, 0.44%, and 0.37%, respectively.

Digging Deeper into AMD’s Ownership Structure

Looking closely at top shareholders, Vanguard owns the highest stake in AMD at 8.23%. Next up is Vanguard Index Funds, which holds a 7.21% stake in the company.

Among the top ETF holders, the Vanguard Total Stock Market ETF (VTI) owns a 3.14% stake in Advanced Micro Devices stock, followed by the Vanguard S&P 500 ETF (VOO), with a 2.50% stake.

Moving to mutual funds, Vanguard Index Funds holds about 7.21% of AMD. Meanwhile, Fidelity Concord Street Trust owns 1.73% of the company.

Is AMD a Buy or Sell Now?

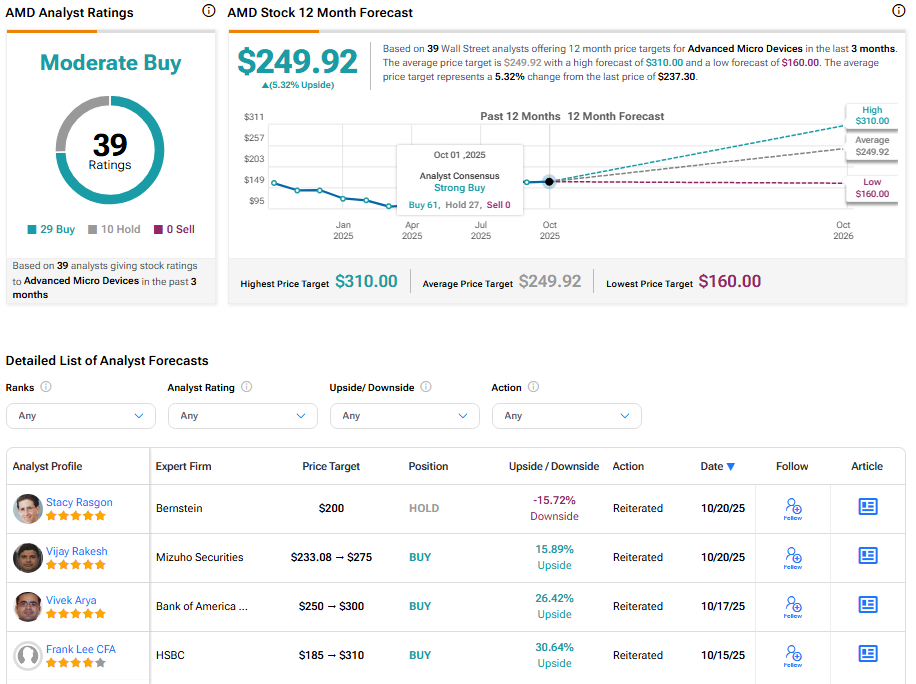

According to TipRanks, AMD stock has a Moderate Buy consensus rating based on 29 Buys and 10 Holds. The average AMD stock price target of $249.92 indicates a possible upside of 5.39% from current levels.