2023 has been a good year for Ardelyx (NASDAQ:ARDX). With the stock up over 188% over the past year, and a Strong Buy consensus rating from Wall Street, markets await the company’s Q4 2023 earnings and any indication that the recent 12-month bullish streak has more room to run. The biopharmaceutical company is scheduled to announce its Q4 and full-year 2023 results after the market closes on February 22.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Ardelyx has beaten earnings per share (EPS) estimates twice and surpassed revenue expectations for all three quarters of 2023. With recent positive developments in its approved commercial products, analysts are projecting more upside in ARDX stock price over the next 12 months.

Medicine for the Portfolio

Founded in 2007 and headquartered in Fremont, California, Ardelyx is a biopharmaceutical company researching, developing, and commercializing medicines to treat gastrointestinal and cardiorenal diseases.

One of its leading medications, IBSRELA, is an innovative treatment for irritable bowel syndrome and chronic kidney disease (CKD). The company recently announced ongoing progress with the expanded use of the drug and anticipates it to surpass $1 billion in annual sales at its peak (doubling previous peak sales projections).

The projected growth for IBSRELA sales and the recent FDA (Food and Drug Administration) green-lighting of the other commercial product approved in the United States, XPHOZAH, which treats chronic kidney disease (CKD) in dialysis patients, have Wall Street analysts following the stock with a bullish outlook.

Coming to Q4 2023 results, analysts expect Ardelyx to report a loss per share of $0.01 in Q4 2023 compared to an EPS of $0.06 in the prior-year quarter. The company reported a surprise profit of $0.03 in the third quarter against analysts’ expectations of a loss per share of $0.11. Any such favorable earnings beat for Q4 2023 might drive the stock higher.

Is ARDX a Good Stock to Buy?

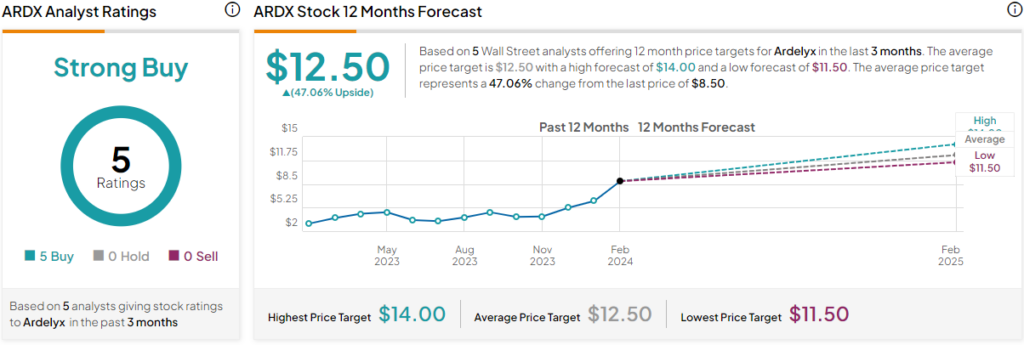

Piper Sandler analyst Christopher Raymond maintained a Buy rating on Ardelyx on February 21 and set a price target of $12. Last month, analysts at Ladenburg, Wedbush, and Citi also reaffirmed their bullish stance with Buy ratings.

Overall, ARDX is rated a Strong Buy based on ratings from five Wall Street analysts who offered their views on the stock in the past three months. Their average price target is $12.50, with a high forecast of $14.00 and a low forecast of $11.50. The average price target represents 47.06% upside based on Wednesday’s closing price of $8.50.

Last Call

The anticipation for Ardelyx’s Q4 earnings results is high, with the company having a history of beating estimates. Investors will surely keep a close eye on any updates regarding the expanded use of IBSRELA and any other developments within the company offered in the Q4 earnings announcement. If, as analysts anticipate, Ardelyx is set up for continued success, the price movement in the stock will be worth watching.