Following a nearly 37% slide in its share price over the past year, biopharmaceutical giant Bristol-Myers Squibb (NYSE:BMY) has announced an additional share repurchase program worth $3 billion. The announcement has sent BMY shares flying higher today. The new program now takes BMY’s total outstanding stock buyback authorization to nearly $5 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For investors, the share repurchase announcement comes on top of a 5.3% dividend increase the company announced yesterday. The quarterly dividend of $0.60 per share pegs the annual dividend for Fiscal Year 2024 at $2.40 per share. The quarterly BMY dividend is payable on February 1, 2024, to investors of record on January 5, 2024. Impressively, this is the 15th consecutive annual dividend increase for the company.

Additionally, BMY has announced a quarterly dividend of $0.50 per share on its $2 convertible preferred stock. The dividend is payable on March 1 to investors of record on January 30.

Last week, BMY expanded its global licensing and research collaboration with Avidity Biosciences (NASDAQ:RNA) in a $2.3 billion deal. The two partners will focus on developing up to five cardiovascular targets by utilizing Avidity’s AOC (Antibody Oligonucleotide Conjugates) platform technology.

What is the Target Price for BMY?

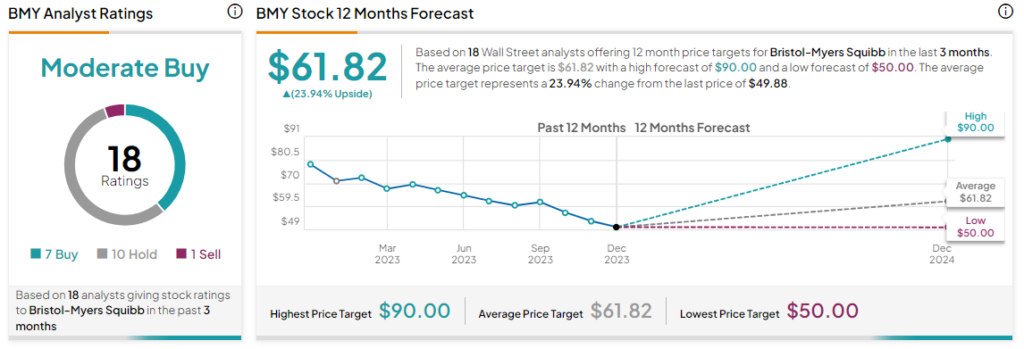

Overall, the Street has a Moderate Buy consensus rating on Bristol-Myers Squibb. The average BMY price target of $61.82 points to a substantial 24% potential upside in the stock.

Read full Disclosure