The holiday shopping season is about to start up in earnest, and some early birds have probably even already started making their lists and checking them twice. That’s giving Affirm Holdings (NASDAQ:AFRM) a bit of an edge in the market as it looks at a new way to gain some of that market. Investors, however, weren’t at all pleased, as Affirm lost over 6.5% in Thursday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Affirm made a name for itself in financial services, specifically, the buy-now-pay-later (BNPL) service that has become increasingly popular with stores as of late. Now, Affirm Holdings is looking to offer a subscription service, according to Bloomberg. How do you offer a subscription to a payment service? Simple; you offer a guaranteed 0% interest rate on all BNPL loans in exchange for the regular subscription. Affirm’s plan is to charge customers $7.99 per month to get access to Affirm Plus, the program offering the loans. Moreover, customers with the $7,00 plan would give them access to a rate of 4.75% on the Affirm savings account, up from the 4.35% standard rate.

While investors don’t seem particularly happy about this move, it could prove helpful in the long run. After all, BNPL services have delivered plenty of value to businesses already. Customers find the ability to get what they want now, yet pay for it over time, to be gratifying and a great way to get what they want without breaking the bank today. Given the environment we’re going into, making customers feel better about shopping might mean the difference between a great season and a poor one.

Is Affirm Holdings a Good Stock to Buy?

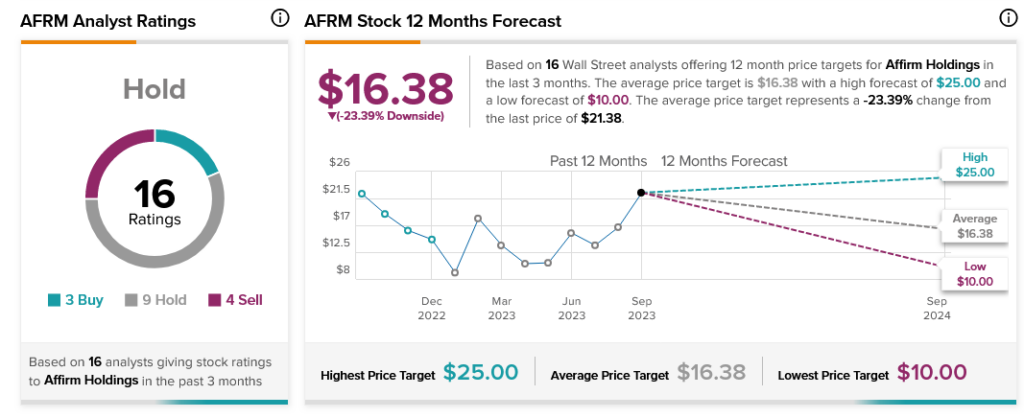

Analysts are hesitant about Affirm Holdings. Currently, Affirm Holdings stock is rated a Hold, with three Buy ratings, nine Holds, and four Sells. Plus, with an average price target of $16.38, Affirm Holdings stock comes with 23.39% downside risk.