Up in Canada, energy stock Advantage Energy (TSE:AAV) managed to land a major new investment in one of its key subsidiaries. The new investment was sufficiently sizable to catch other investors’ attention as well, and Advantage Energy is up over 3% in Wednesday afternoon’s trading.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Advantage Energy owns a company called Entropy, located in Calgary, which is working to develop a series of “carbon capture and sequestration” products. That makes sense, given that Advantage Energy itself deals heavily in carbon-producing products like oil and natural gas. Now, the Canada Growth Fund has taken notice of Entropy’s work and put $200 million into the operation. The investment also comes with a credit purchase agreement, which extends up to one million tons annually. This is considered “…a global first in climate markets,” as well as a means to “establish…price certainty” in the carbon credit market.

Yet, Active Concerns Remain

While this is certainly a great move for Advantage Energy and the Canada Growth Fund, there are still concerns about Advantage Energy’s ability to compete and make returns in the broader market. Even with this investment, some signs indicate potential trouble ahead. For instance, Advantage Energy’s return on equity comes in at about 11%, which is below the industry average of 17% but still within shouting distance. In fact, its net income growth is doing better than the industry average, coming in at 52% against the average of 43%. However, that growth rate is expected to slow down going forward, which isn’t surprising given the macroeconomic conditions.

Is Advantage Energy a Good Buy?

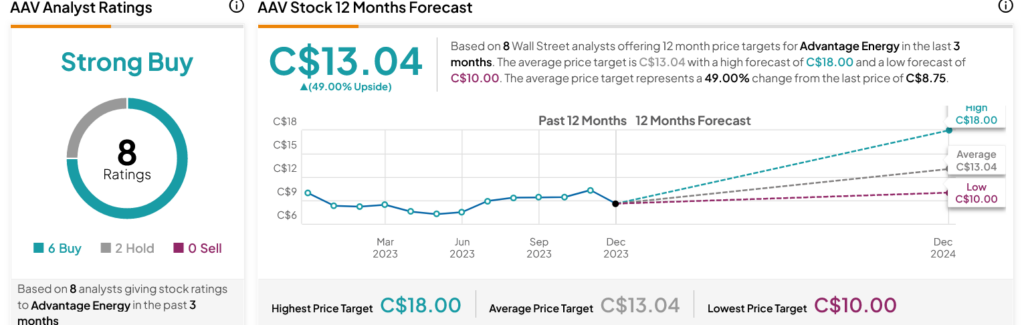

Turning to Wall Street, analysts have a Strong Buy consensus rating on Advantage Energy stock based on six Buys and two Holds assigned in the past three months, as indicated by the graphic below. After a 11.36% loss in its share price over the past year, the average Advantage Energy price target of C$13.04 per share implies 49% upside potential.