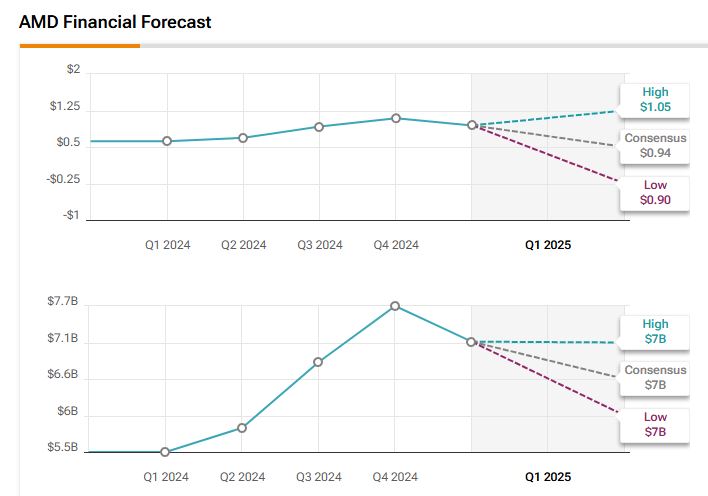

Advanced Micro Devices (AMD) is set to report its Q1 2025 earnings on Tuesday, May 6, after the market closes. AMD stock has declined 18% in 2025 so far because of new U.S. export restrictions to China, tough competition from Nvidia (NVDA), and tariff concerns, among others. Wall Street analysts expect the company to post earnings of $0.94 per share, up 52% from the year-ago quarter. Also, revenues are expected to increase by about 30% from the year-ago quarter to $7.12 billion, according to data from the TipRanks Forecast page.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Notably, AMD has an encouraging earnings surprise history. The company missed earnings estimates just twice out of the previous nine quarters.

Recent Event Ahead of Q1 Print

Last month, AMD closed its $4.9 billion deal to buy ZT Systems, a maker of hyperscale servers. The move brings together AMD’s chips and networking tech with ZT’s strength in building large server systems and AI setups. This deal helps speed up the design and rollout of large AI clusters, strengthening AMD’s position in the fast-growing AI space.

Analyst’s Views Ahead of AMD’s Q1 Earnings

Ahead of AMD’s Q1 results, Seaport Research analyst Jay Goldberg initiated coverage on the stock with a Buy rating and a $100 price target, citing the company’s growing footprint in the data center space. The analyst also noted AMD’s expanding role in artificial intelligence, highlighting its recent $5 billion acquisition of ZT Systems as a key step to boost its AI capabilities. According to Main Street Data, AMD’s data center revenue rose 69% year-over-year to $3.86 billion in Q4 2024.

In contrast, Bernstein analyst Stacy Rasgon lowered his price target on AMD to $95 from $125 and kept a Hold rating, pointing to several challenges the company is currently facing. These include new U.S. restrictions on AI chip sales to China, higher costs from acquiring ZT Systems, and weak demand in PCs, gaming, and embedded markets. As a result, for now, he prefers to stay on the sidelines.

Options Traders Anticipate a Large Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 8.70% move in either direction.

Is AMD Stock a Good Buy?

On TipRanks, AMD holds a Moderate Buy consensus based on 22 analyst ratings—15 Buys and seven Holds, with no Sells in sight. The average AMD price target is $126.74, suggesting a potential upside of 28.28% from current levels.