Advanced Micro Devices (AMD) remains a key pick for top Bank of America semiconductor analyst Vivek Arya, who reaffirmed his Buy rating and $300 price target, suggesting around 22% upside from current levels.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Why AMD Stays on BofA’s “Buy” List

Arya expects AMD’s upcoming MI400 GPU series to be key to its move into large-scale AI systems. He said this new platform, along with AMD’s strong CPU lineup, should help the company win more deals with big cloud providers, even as Nvidia (NVDA) leads current AI chip sales.

The analyst added that AMD’s AI roadmap will be in focus at its next Analyst Day, where management is likely to outline long-term goals. While there may be questions about AMD’s OpenAI partnership and timelines, Arya sees those as short-term concerns.

He noted that AMD’s mix of CPU and GPU products gives it a “balanced footing” in the AI market. The company is expected to keep taking share from Intel (INTC) in server chips while expanding its role in high-end GPUs used for AI training and inference.

Valuation and Upside Potential

BofA’s $300 price target values AMD at 32x expected 2027 earnings — roughly the midpoint of its past trading range of 14x to 55x. Arya said this reflects his confidence in AMD’s AI-driven growth and continued CPU share gains, even as sales from embedded and console segments slow.

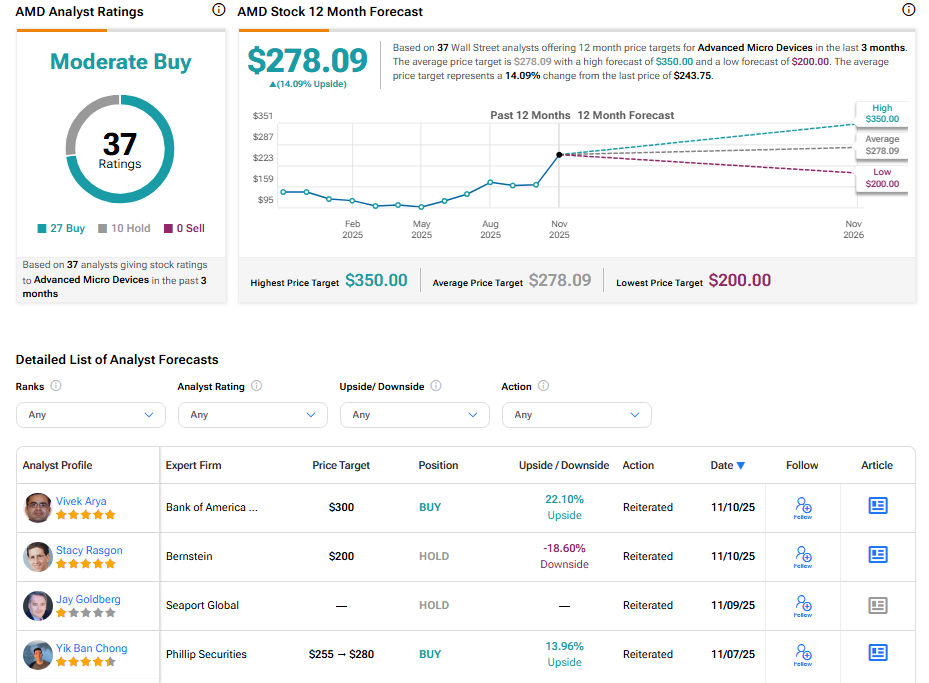

Is AMD Stock a Buy or Sell?

Currently, Wall Street has a Moderate Buy consensus rating on Advanced Micro Devices stock based on 27 Buys and 10 Holds. The average AMD stock price target of $278.09 indicates 14.09% upside potential from current levels.