American pipe manufacturer Advanced Drainage Systems’ (WMS) shares gained during early trading on Tuesday after the company disclosed its planned $1 billion acquisition of the water management business of Germany’s Norma Group. The Ohio-based manufacturer will acquire the unit in an all-cash transaction through a stock purchase.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The unit is called the National Diversified Sales (NDS). NDS manufactures technological products that help manage water on properties, focusing on stormwater drainage, irrigation, and flow control. These solutions are designed to prevent flooding, conserve water, and safeguard landscapes.

Advanced Drainage expects the purchase to boost its adjusted earnings per share during its first year. This is even as NDS generated about 90% of its revenue over the last year ending in June from the U.S., bringing in $313 million.

Advanced Drainage Expects Cost Savings

Moreover, Advanced Drainage, which also designs and supplies products for stormwater management, expects the acquisition cost to drop to about $875 million after factoring in expected tax savings. The company plans to fund the acquisition through available cash and its existing credit line capacity, which refers to a pre-approved loan facility.

Also, Advanced Drainage pointed out that the value of the deal, minus the tax benefits, “represents a multiple of approximately 10x NDS adjusted EBITDA” over the last 12 months ended June. It also factored in expected cost savings annually from combining its operations with the unit into this calculation.

The deal, which has been approved by the boards of both companies, is expected to be sealed by the first quarter of next year. It is also conditional on regulatory approval.

Precision Irrigation Sees Uptake

Norma has expanded NDS in recent years through acquisitions. The company’s primary customers in the U.S. are predominantly from the agricultural sector.

Advanced Drainage’s buyout plan comes amid growing adoption of precision irrigation and automation technology by farmers to address water scarcity, especially in Western U.S. states such as California and Arizona. The precision irrigation market is expected to grow from $2.15 billion in 2024 to about $4.72 billion by 2033, according to Renub Research.

Is WMS a Good Stock to Buy?

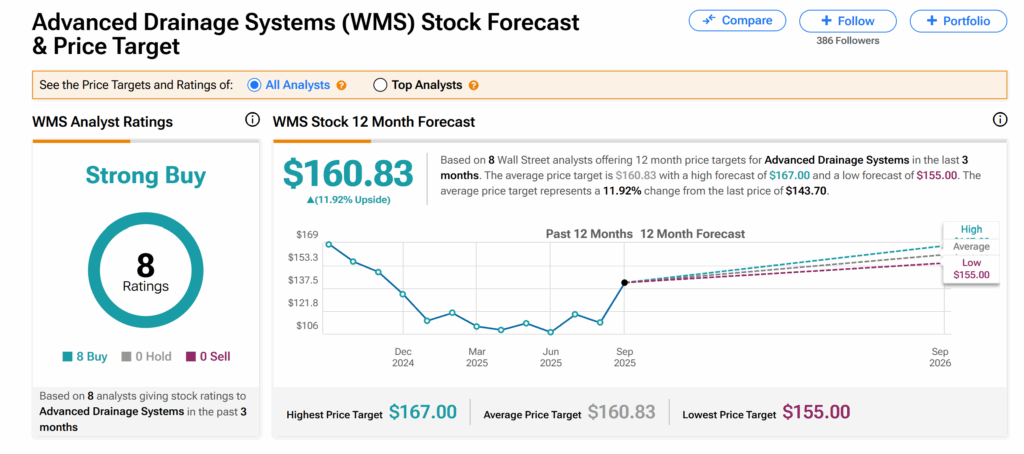

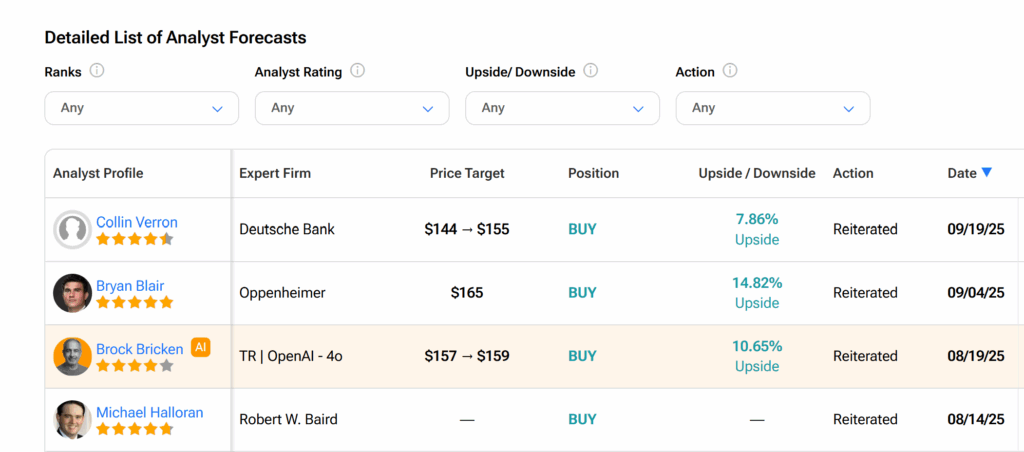

Turning to Wall Street, Advanced Drainage’s shares have a Strong Buy consensus recommendation on TipRanks, based on eight Buys assigned over the last three months by Wall Street analysts.

Furthermore, the average WMS price target of $160.83 indicates a 12% potential increase from the current level.