Advance Auto Parts (NYSE:AAP) received mixed reactions from analysts following the release of its third-quarter results yesterday. Since the release, one analyst has rated AAP stock as a Buy, two have given it a Hold, and one analyst has assigned a Sell rating.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

One of the neutral analysts is Top-rated analyst Zachary Fadem from Wells Fargo. The analyst remains impressed with the company’s improving comparable sales and cost-saving measures. However, he believes that falling margins, rising uncertainty from divestitures, and lingering structural disadvantages remain key concerns.

Another analyst, Elizabeth Lane Suzuki from Bank of America Securities, downgraded AAP’s rating to Sell from Hold. She also lowered the price target to $43 from $60.

It is worth mentioning that AAP stock declined about 5% in yesterday’s trading session. The company swung to a loss of $0.82 per share in the third quarter and missed analysts’ expectations of earnings of $1.44 per share. Meanwhile, net sales totaled $2.7 billion in Q3 and exceeded analysts’ expectations of $2.68 billion.

Is AAP Stock a Buy?

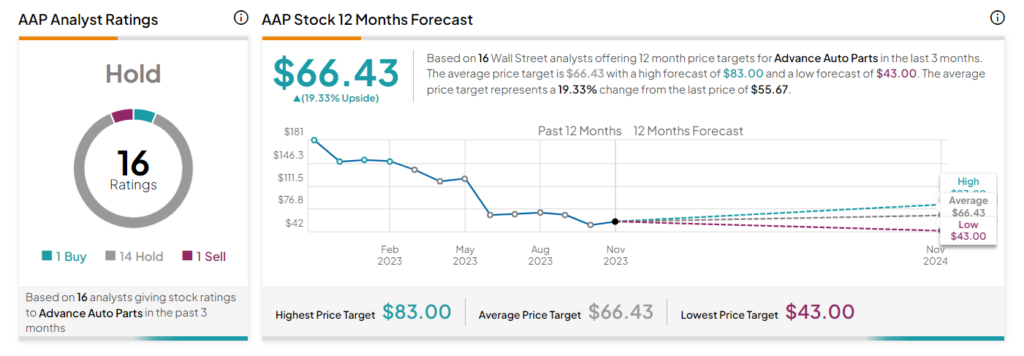

On TipRanks, AAP stock has a Hold consensus rating based on one Buy, 14 Holds, and one Sell. The average stock price target of $66.43 implies a 19.3% upside potential. The stock is up more than 62.5% so far in 2023.