Shares of Advance Auto Parts (NYSE:AAP) closed 3.7% higher on March 11. Further, it gained about 1.9% in after-hours trading as the leading automotive aftermarket parts provider made peace with activist investors, including Dan Loeb’s hedge fund, Third Point, and Saddle Point Management.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company appointed A. Brent Windom, Gregory L. Smith, and Thomas W. Seboldt as independent directors to its board, effective immediately. Concurrently with these appointments, a cooperation agreement has been established between the company and Third Point and Saddle Point Management.

It is important to highlight that the company is struggling to drive its top-line performance due to tough year-over-year comparisons and softness in the do-it-yourself (DIY) market. Meanwhile, its SG&A expenses have grown faster than sales throughout 2023. Therefore, this settlement with activist investors seems to be a positive development and could help the company implement organizational changes to spur growth.

Is Advance Auto Parts Stock a Good Buy?

Advance Auto Parts stock has decreased by about 37.5% in one year, significantly underperforming its peer AutoZone’s (NYSE:AZO) gain of nearly 26%. Nonetheless, AAP is taking initiatives to reaccelerate its growth and boost profitability.

In this regard, the company is exiting non-core operations, implementing significant cost reductions, and focusing on improving the productivity of all assets. While investors have cheered the company’s initiatives, as reflected by the recent recovery in its share price, Wall Street remains sidelined.

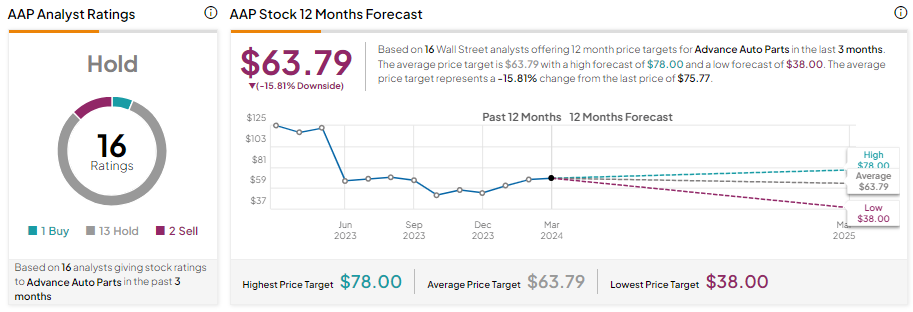

Advance Auto Parts stock has a Hold consensus rating with one Buy, 13 Hold, and two Sell recommendations. Analysts’ average price target on AAP stock is $63.79, implying 15.81% downside potential from current levels.