Shares of Advance Auto Parts (NYSE:AAP) saw a nice bump today thanks to some buzz from activist fund Legion Partners. At the Bloomberg Activism Forum 2023, Legion’s Chris Kiper highlighted that Advance Auto’s stock is currently hovering near a 12-year low and trailing behind competitors like O’Reilly Automotive (NASDAQ:ORLY) and AutoZone (NYSE:AZO).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Kiper’s got his eyes on a big prize, believing that Advance Auto’s WorldPac wholesale distribution business, valued around $1.8 billion, will draw significant attention in its upcoming sale process. He’s optimistic about the stock’s potential, suggesting it could triple from current levels if the company can push its EBITDA margins back to 12%.

Kiper feels confident about this goal, saying at the conference, “We think this is really doable.” This optimism stems from what he describes as “constructive” discussions with Advance Auto thus far.

Is Advance Auto Parts a Buy or Sell Stock?

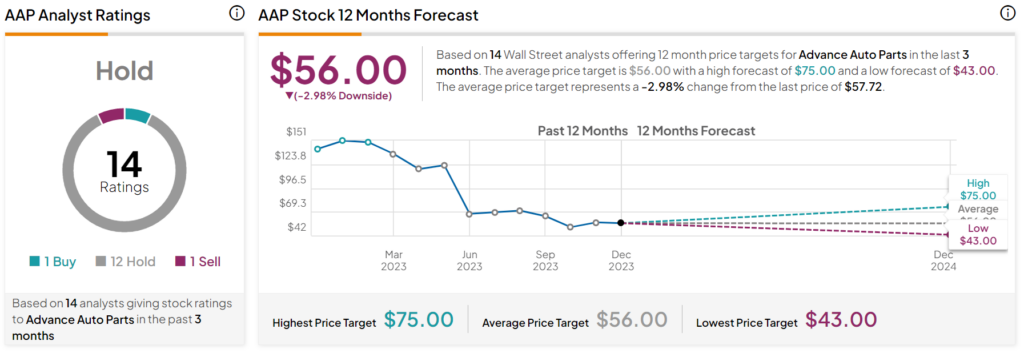

Turning to Wall Street, analysts have a Hold consensus rating on AAP stock based on one Buy, 12 Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Despite a 61% decline in its share price in 2023, the average AAP price target of $56 per share still implies some further downside risk.