Usually, when a stock posts a solid earnings report, it can count on a decent gain in its share price. That’s just what happened for Automatic Data Processing (NASDAQ:ADP), who added over 5% in Wednesday afternoon’s trading thanks to some very solid numbers.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The numbers for ADP turned out rather nicely. While earnings was a fairly close beat—coming in at $1.89 per share against analyst projections that called for a nearly-identical $1.83—revenue offered a healthier margin. ADP posted revenue of $4.5 billion against analyst projections that called for $4.39 billion. Not only was that a win, but it was also up 9% on a constant currency basis against the same time the previous year.

Individual sector data also offered a lot of positives. Employer Services were up 11%, while new business, in general, was up a healthy 10%. Even PEO Services managed to kick things up a decent 4%. And, just to round it out, ADP also offered some winning projections for the full year 2024 as well. It looks for revenue to increase between 6% and 7% while also posting earnings per share growth between 10% and 12% on both a diluted and adjusted diluted measure.

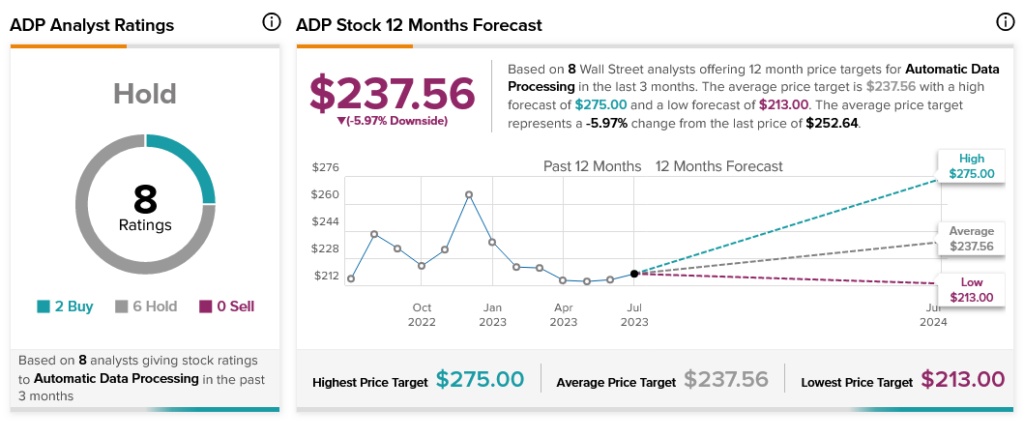

As good as these results were, they’re not enough to shake analysts off the fence. Currently, analyst consensus calls ADP stock a Hold by virtue of two Buy ratings and six Holds. Further, with an average price target of $237.56, the latest price action gave ADP stock 5.97% downside risk.