Software giant Adobe’s (NASDAQ:ADBE) $20 billion proposed acquisition of cloud-based designer platform Figma is facing increasing hurdles from regulators across the globe. As per the Financial Times, European Union (EU) antitrust regulators are preparing to launch a formal antitrust investigation into the Adobe-Figma deal later this year.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Adobe-Figma Deal Faces More Scrutiny

EU regulators are concerned that Adobe’s acquisition of Figma would impact innovation and enable the company to drive the prices higher. Instead of the “phase 1” investigation that generally lasts for a few months, EU regulators are reportedly planning to go ahead with a more detailed “phase 2” probe that could last longer and eventually block the proposed acquisition.

According to the European Commission, Adobe has not yet formally presented the deal for scrutiny. “If a transaction constitutes a concentration and has an EU dimension, it is always up to the companies to notify it,” clarified the Commission.

Earlier this year, EU regulators made it clear that Photoshop maker Adobe would have to secure antitrust approval for the Figma acquisition, despite the European sales from the deal falling below the bloc’s turnover threshold for a review. The EU backed its decision citing concerns that the potential deal “threatens to significantly affect competition in the market for interactive product design and whiteboarding software.”

Last month, the U.K. initiated an inquiry into the deal, which was originally announced in September 2022. Additionally, the U.S. Department of Justice (DOJ) is reportedly set to file a lawsuit to block the proposed acquisition.

In separate statements to Reuters, Adobe said that it is in the preliminary phase of the regulatory process and having constructive discussions with the U.K., EU, and U.S. regulators about the deal, while Figma said that it looks forward to continued conversations with regulators.

Is Adobe Stock a Buy or Sell?

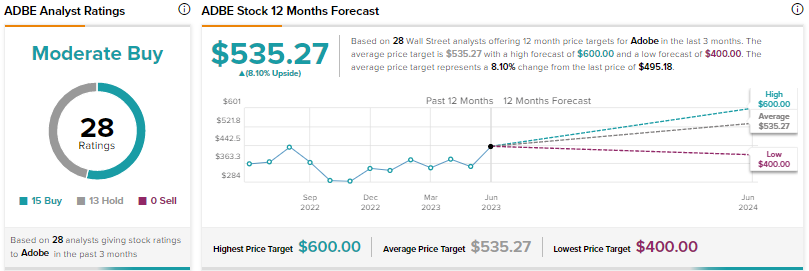

Last week, Wells Fargo analyst Michael Turrin raised his price target for Adobe stock to $600 from $525 and reiterated a Buy rating after the company reported upbeat fiscal Q2 results and raised its full-year outlook. The analyst sees more upside in ADBE shares, as the company delivered solid upside to Q2 estimates and provided favorable details related to artificial intelligence monetization.

With 15 Buys and 13 Holds, Adobe scores Wall Street’s Moderate Buy consensus rating. The average price target of $535.27 implies 8.1% upside. Shares have rallied over 47% year-to-date.