Adobe (NASDAQ:ADBE) is kicking off the day on a high note, with shares rising at the time of writing. The enterprise software giant revised its profit and revenue forecasts upward for the rest of the fiscal year, an optimistic move that did not go unnoticed on Wall Street. Barclays analyst, Saket Kalia, attributes Adobe’s impressive performance to a pricing advantage that he suspects might become even more significant in the second half of the year. Kalia, who upped his per-share price target from $485 to $540 following these results, believes Adobe has three ways to cash in on its Firefly AI tool. The creative co-pilot use could enhance average revenue per user; increased engagement could drive higher retention, and Adobe might attract more paid users through a freemium model.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Meanwhile, UBS analyst Karl Keirstead, who also raised his per-share price target from $440 to $525, singled out the Creative segment as the pleasant surprise. This segment witnessed a 14% constant currency revenue growth and annual recurring revenue growth of around $354M, helping to assuage investor concerns. Keirstead also noted Adobe’s potential benefits from generative AI.

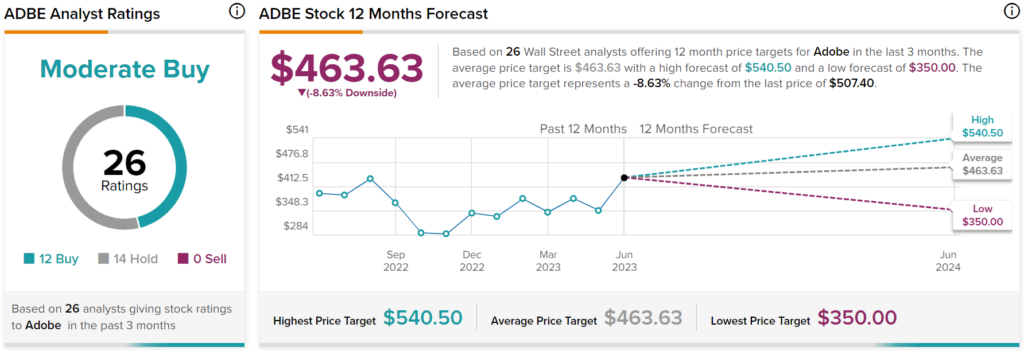

Overall, Wall Street analysts have a consensus price target of $463.63 on ADBE stock, implying 8.63% downside potential, as indicated by the graphic above.