Activision (NASDAQ:ATVI) recently came off a comparatively solid earnings report. That’s good news for a video game company these days, particularly when so many of 2022’s releases were delayed to 2023. But with Activision already facing a new challenge with its upcoming merger with Microsoft (NASDAQ:MSFT), CEO Bobby Kotick is challenging its greatest foe on this front: London.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Kotick took note of Prime Minister Rishi Sunak’s ambition to make the UK the “Silicon Valley” of Europe and used it against him. Kotick said that if the UK continues to challenge Microsoft’s acquisition of Activision, then the UK would end up the Death Valley of Europe rather than Silicon Valley. However, Kotick does believe that the deal can ultimately be completed; it just requires UK regulators to get out of their own way.

The deal has had no shortage of opponents. Nvidia (NASDAQ:NVDA) and Alphabet (NASDAQ:GOOG) also stepped in to tackle the deal. The duo noted that they opposed the acquisition mainly on the issue of easy access to games for all consumers, regardless of the platforms involved. Meanwhile, Sony (NYSE:SONY) is actively fighting a recent subpoena from Microsoft and the Federal Trade Commission about the matter.

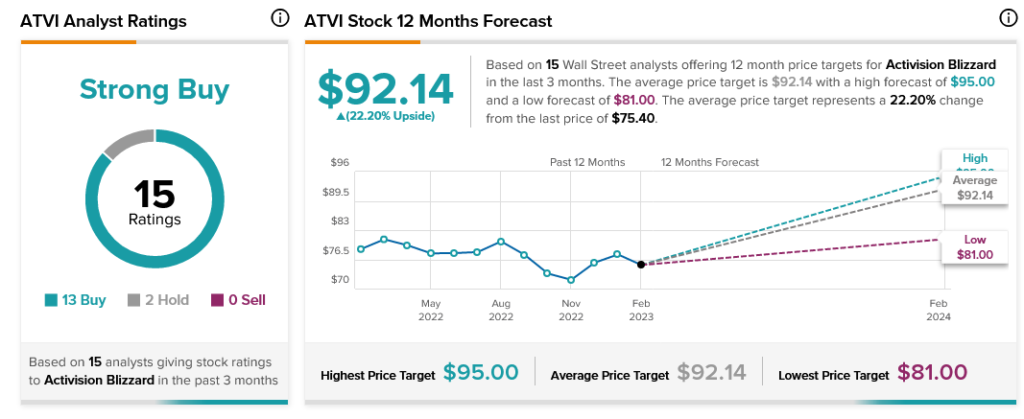

Activision expects the deal to go through, and its stock is up substantially with investors in Tuesday afternoon trading. Analyst consensus, meanwhile, calls Activision a Strong Buy with 22.2% upside potential thanks to its average price target of $92.14.