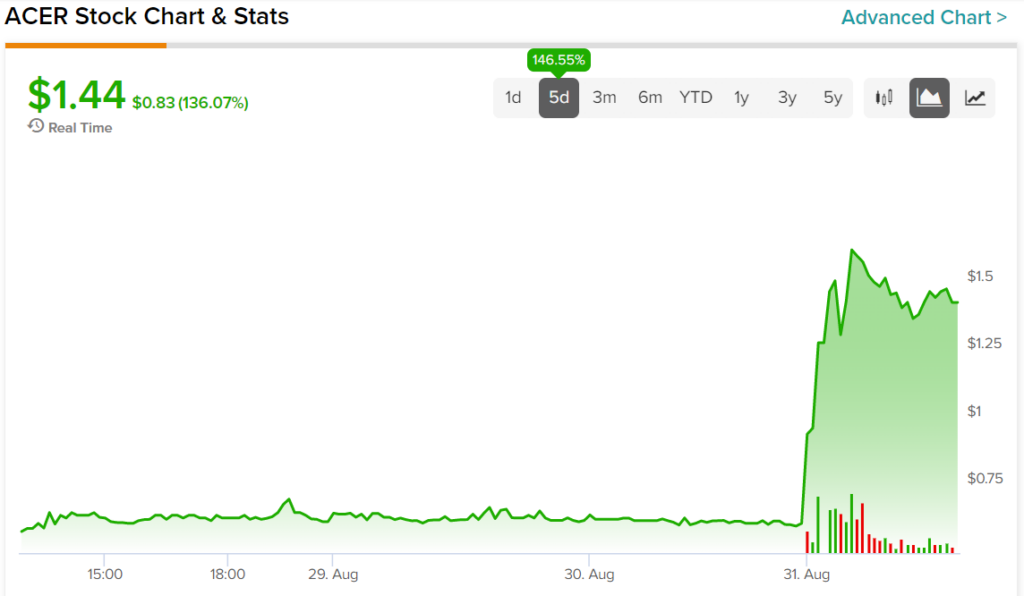

Acer Therapeutics (NASDAQ:ACER) shares are up over 136% at the time of writing today after the pharmaceutical company agreed to be acquired by Zevra Therapeutics (NASDAQ:ZVRA) in a merger transaction. Zevra, a rare disease company, is focused on developing therapies for diseases with limited or no treatment options. The transaction is anticipated to close in the fourth quarter of this year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The total transaction consideration of $91 million includes ~2.96 million Zevra shares valued at $15 million (0.121 of a Zevra share for each Acer share), along with potential cash payments of up to $76 million. The cash payments are related to non-transferable contingent value rights upon the achievement of certain milestones for Acer’s Olpruva and Edsivo. Additionally, Zevra is also providing a $16.5 million bridge loan facility to Acer.

Importantly, the transaction is expected to boost Zevra’s rare disease portfolio while diversifying its revenue streams. Acer’s Olpruva is approved for the treatment of UCDs (Urea Cycle Disorders) and promises to be a strategic fit for Zevra. UCDs are a group of genetic disorders that can lead to brain damage and neurocognitive impairments. Acer’s Edsivo is targeted for the treatment of vascular Ehlers-Danlos syndrome.

A look at the past five trading days for ACER stock highlights the level of impact today’s news had on it. Indeed, investors are now up 146.55% during this timeframe.

Read full Disclosure