Investors looking for a steady income stream can consider investing in Dividend Aristocrats (stocks that have raised their dividends for at least 25 consecutive years). Abbott Labs (NYSE:ABT) and PepsiCo (NASDAQ:PEP) are two such stocks that can be seen as reliable for income-oriented investors. Also, hedge fund managers have expressed confidence in both of these stocks by increasing their holdings.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Let’s delve deeper into these two Dividend Aristocrat stocks.

Abbott Laboratories

Abbott is a healthcare company known for its diverse range of medical devices, diagnostics, and nutritional products. The company has raised its dividend payout for 51 consecutive years, making it a perfect choice for income investors. ABT’s well-diversified offerings support consistent growth in both earnings and dividends.

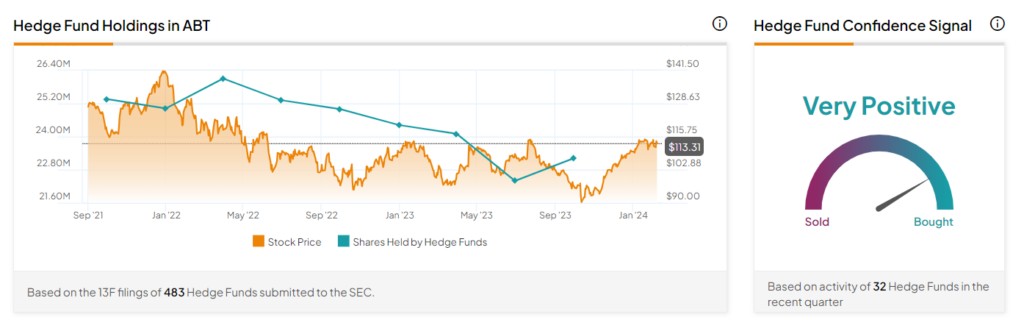

Furthermore, the stock has a “Very Positive” signal from TipRanks’ Hedge Fund Trading Activity tool. The tool shows that hedge funds bought 819,300 shares of this healthcare company in the last quarter. Our data shows that Echo Street Capital Management’s Greg Poole and Bridgewater Associates’ Ray Dalio were among the hedge fund managers who increased their exposure to ABT stock.

What is the Price Target for ABT Stock?

ABT stock has received 11 Buy and two Hold recommendations for a Strong Buy consensus rating. The average Abbott stock price target of $126.15 implies an 11.3% upside potential from the current level. Over the past three months, ABT shares have gained 20.2%.

Supporting the bull case, the stock has a Smart Score of “Perfect 10” on TipRanks, which suggests that it can beat the overall market from here.

PepsiCo

PepsiCo is a global food and beverage company known for its diverse portfolio of iconic brands. PEP has increased dividends for 51 consecutive years. The company continues to gain market share across several businesses, including snacks, sodas, and sports drinks.

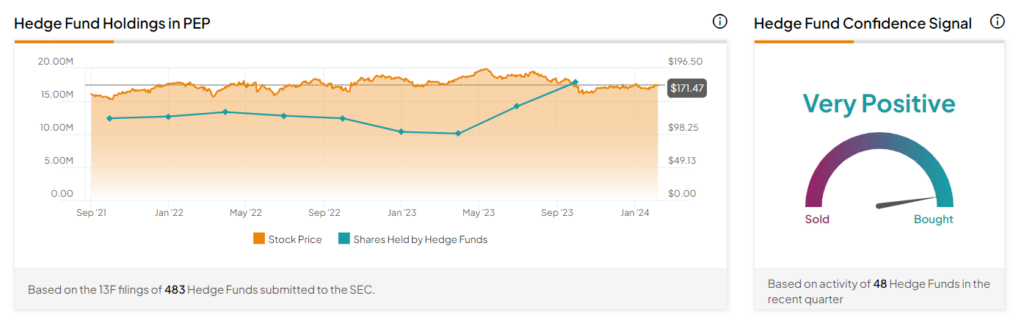

This stock has a “Very Positive” signal from TipRanks’ Hedge Fund Trading Activity tool. Per the tool, hedge funds bought 3.7 million shares of this beverage giant last quarter. According to our database, hedge fund managers Ken Fisher of Fisher Asset Management and Bill & Melinda Gates Foundation Trust’s Bill Gates increased their positions in PepsiCo stock.

Is PepsiCo a Buy, Sell, or Hold?

PepsiCo has a Moderate Buy consensus rating based on three Buy and four Hold recommendations. PEP stock’s 12-month average price target of $186.29 implies 8.6% upside potential from current levels. Shares of the company have gained 3.2% in the past year.

Importantly, PEP has an Outperform Smart Score of nine on TipRanks.

Concluding Thoughts

The Dividend Aristocrat status of ABT and PEP reflects their commitment to rewarding shareholders with regular and growing dividend distributions. Additionally, the bullish view of hedge fund managers helps instill further confidence in these stocks.