Shares of software services provider Absolute Software (NASDAQ:ABST) are in focus today after Crosspoint Capital agreed to acquire the company at an enterprise value of $870 million.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Excluding Absolute’s debt, the deal is valued at $657 million and the company’s investors will receive $11.50 in cash for each ABST share held by them. The consideration represents an impressive 34% premium over the stock’s May 10 closing price of $8.58.

Crosspoint’s expertise in cybersecurity is expected to drive the next leg of growth for Absolute. Christy Wyatt the President and CEO of Absolute exclaimed, “For the past five years, our focus has been on creating the industry’s only truly self-healing security platform centered on resilience. By partnering with Crosspoint…we are delivering immediate cash value to our shareholders while positioning Absolute for an exciting future across all key stakeholders.”

The transaction has been unanimously approved by Absolute’s Board and is anticipated to close in the second half of this year. Upon closing, shares of the company will cease to trade on any public markets.

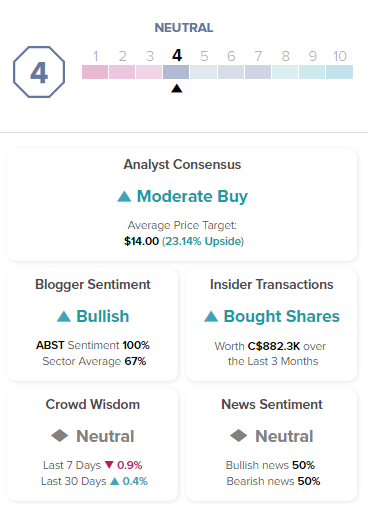

Our data dive at TipRanks indicates Blogger Sentiment on the stock remains buoyant while insiders have lapped up nearly C$882,300 worth of ABST shares over the past three months.

Read full Disclosure