Shares of Abercrombie & Fitch Co. (NYSE: ANF) jumped over 5.5% during the extended trading session on January 10, after the company reported that it witnessed accelerated demand from consumers over the holiday season and beyond.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

However, the company added that it was not able to meet the robust demand as it fell short on inventory due to extended port and transportation delays. This led to lost sales during the peak holiday selling period. Likewise, the company trimmed its fourth-quarter sales expectations.

Q4 and FY2021 Revenue

Ahead of its upcoming earnings for the fourth quarter and full year on January 11, 2022, the company stated all brands were impacted due to transportation delays. Hollister and Gilly Hicks brand bore the highest impact.

For the full year of 2021, revenues are expected to grow 19% to 20% year-over-year. Compared to 2019, the expected growth is 2% to 3%. Operating margin will remain in-line with the previous outlook at 9% to 10%, and will be much higher compared to adjusted operating margin of 1.7% and 2.3% in fiscal 2020 and fiscal 2019, respectively.

The company also slashed its planned capital expenditures for the year to a range of $90 million to $95 million, lower than the prior guidance of $100 million.

For Q4, revenues are not expected to grow 4% to 6% year-over-year. However, compared to 2019, the growth is flat to down 2% versus the prior outlook of up 3% to 5% growth.

The company stated that it will not be able to meet the prior outlook of up 3% to 5% growth compared to 2019 due to additional unexpected and uncontrollable inventory receipt delays, and increased COVID-related impacts and restrictions.

However, Q4 gross margin will remain in-line with the previous outlook and will be flat to 2019 levels of 58.2%, driven by double-digit improvement from reduced promotions and markdowns, and offset by higher freight cost pressure.

CEO Comments

The company’s CEO, Fran Horowitz, commented, “Strong response to our winter and holiday collections, including standout performance in jeans, dresses and sweaters, enabled us to maintain our planned promotional cadence, including reducing the depth of our promotions over the peak Black Friday/Cyber Monday period and throughout December.”

He further added, “We believe that, if we had the inventory on-hand, we would have delivered sales within our previous outlook range. Post-holiday, as inventory has landed, we have experienced an acceleration in sales trend. Looking ahead, we expect to minimize the gross margin impact of late deliveries by balancing promotional depth and utilizing pack-and-hold where appropriate.”

Wall Street’s Take

On January 7, UBS analyst Jay Sole downgraded Abercrombie & Fitch to Hold from Buy and decreased the price target to $37 (14.4% upside potential) from $68 earlier.

Based on Sole’s expectations of inflation, lapping fiscal stimulus and contracting margins, he forecasts valuation pressure and downward revisions for the soft line retail space. Likewise, he expects “macro forces” to slow down growth for Abercrombie.

The Wall Street community is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 3 Buys, 3 Holds and 1 Sell. The average Abercrombie Fitch price target of $47.25 implies 44.81% upside potential to current levels.

Bloggers Weigh In

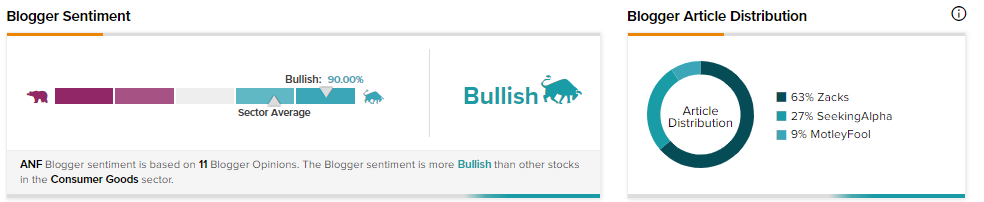

TipRanks data shows that financial blogger opinions are 90% Bullish on ANF stock, compared to a sector average of 73%.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Download the TipRanks mobile app now

Related News:

Greenbrier Shares Drop 5.8% Despite Strong Q1 Result

Cytokinetics Gets $450M Long-Term Funding From Royalty Pharma

Owens & Minor to Acquire Apria, Inc. for $1.6B; Shares Drop 7%