Shares of AbbVie (NYSE:ABBV) sank on Friday after the pharmaceutical company reported first-quarter results. Despite beating earnings estimates ($2.31 per share versus $2.26 per share), news that Cigna (NYSE:CI) will offer a biosimilar of AbbVie’s blockbuster drug, Humira, with no out-of-pocket costs spooked investors. The drug is used to treat several autoimmune conditions, such as Crohn’s disease, rheumatoid arthritis, and ulcerative colitis.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Cigna’s Evernorth plans to start distributing the biosimilar through its Accredo specialty pharmacy in June, which will be supported by a copay assistance program from Quallent Pharmaceuticals, an Evernorth affiliate. This initiative is projected to save patients an average of $3,500 annually, according to Reuters. Additionally, the biosimilar will be priced approximately 85% lower than Humira.

AbbVie’s latest earnings report revealed a significant 36% decline in global sales of Humira, which totalled $2.27 billion. This comes after nine Humira biosimilars were introduced in the U.S. market last year.

Is ABBV a Strong Buy?

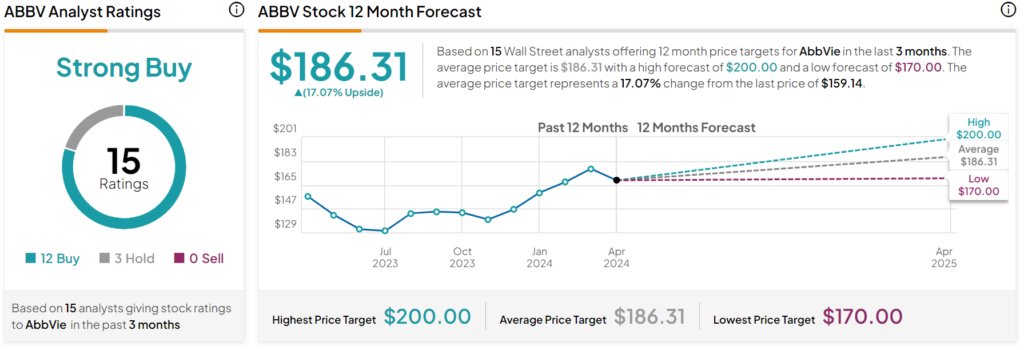

Turning to Wall Street, analysts have a Strong Buy consensus rating on ABBV stock based on 12 Buys, three Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After an 11% rally in its share price over the past year, the average ABBV price target of $186.31 per share implies 17.07% upside potential.