Apple’s shares (NASDAQ:AAPL) are on the rise as Wedbush Securities thinks the tech titan could be worth a whopping $4 trillion. According to analyst Dan Ives, Apple’s strategy is more sophisticated than its rivals. The tech powerhouse is set to generate almost $100 billion in annual services revenue with a double-digit growth rate this year, which is a sharp rise from the nearly $50 billion earned from related services in fiscal 2020. Ives contends that Wall Street is yet to fully recognize the massive potential of this revenue, which he values at around $1.4 trillion, suggesting a fair valuation for Apple at $3.5 trillion, or even up to $4 trillion by fiscal 2025 in a bull case scenario.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

In addition, Ives argues that the market has largely overlooked the upgrading potential surrounding the iPhone. He predicts a “mini super cycle” with the release of the iPhone 15, considering around a quarter of iPhone users haven’t upgraded their devices in the last four years. Furthermore, Apple continues to fortify its ecosystem, particularly with the introduction of the Vision Pro headset, which Ives sees as an extension of the company’s App Store stronghold. He firmly believes this marks the beginning of a broader strategy for Apple to create an AI-driven app ecosystem offering thousands of use cases, from fitness and health to entertainment and more, all built around its loyal customer base.

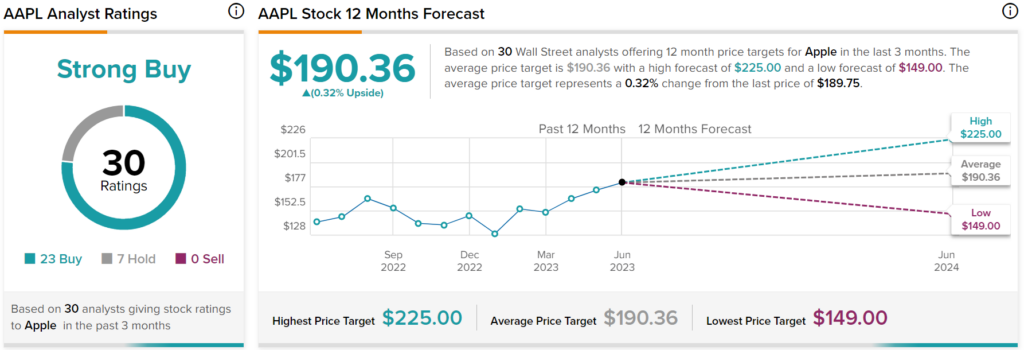

Overall, analysts have a Strong Buy consensus rating on AAPL stock based on 23 Buys, seven Holds, and zero Sells assigned in the past three months, as indicated by the graphic above. Nevertheless, the average price target of $190.36 per share implies less than 1% upside potential.