If the space for artificial intelligence stocks is looking a bit crowded, prepare for a little more claustrophobia. Apple (NASDAQ:AAPL) is stepping into the space, and just gained a little ground in Wednesday afternoon’s trading. It’s all thanks to a new ChatGPT-style tool that Apple put together specifically for its employees.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Apple refers to its new AI advancement as “Ajax,” a large language model that works to connect machine learning capabilities with its own needs. Amazingly, Ajax was based on the Jax system that Google (NASDAQ:GOOG) put out not so long ago, and it not only runs on Apple’s own infrastructure, but also on Google Cloud and Amazon Web Services. Reports suggest that Apple won’t be releasing Ajax to the public, but Ajax is routinely undergoing improvement while Apple measures the consumer market for generative AI systems.

This already effectively changes one investment hypothesis; only yesterday, Jefferies analyst Andrew Uerkwitz declared Apple the “most boring” Buy-rated stock on his list thanks to Apple’s lack of exposure in sectors like AI. Now, we see Apple making a potential run at the AI market. With Apple’s third quarter results approaching, analysts like Wamsi Mohan with Bank of America aren’t expecting much. However, there are some signs that Apple’s Services revenue could bring in better than expected results, and surprise investors overall.

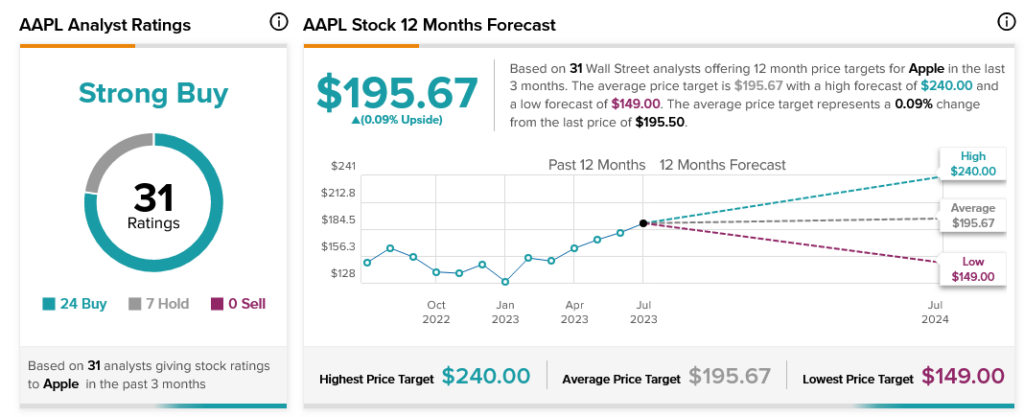

However, analysts are still largely on Apple’s side. With 24 Buy ratings and seven Holds, Apple is still a Strong Buy by consensus figures. However, currently, Apple only boasts fractional upside potential with an average price target of $195.67.