One of the biggest complaints around tech stock Apple (NASDAQ:AAPL) is that it hasn’t been long on innovation lately. Much of what it releases is quite similar to what it’s already released, and there’s no real sign of a big leap forward. However, that may be about to change, as Apple’s virtual reality headset could be out this summer. Word from Evercore also reinforced Apple’s position, and investors drove the price slightly up in Tuesday afternoon trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Evercore ISI, via analyst Amit Daryanani, came out with one new investment thesis: Apple’s already-premium value may go up further. Daryanani called the current valuation “justified,” noting that Apple has delivered on several key metrics already. These include overall return on equity, free cash flow, and not stooping to significant layoffs to manage expenses. Plus, with a target market of consumer staples and high-end luxury, Apple manages to straddle the line well between major markets while insulating its operations from economic uncertainty.

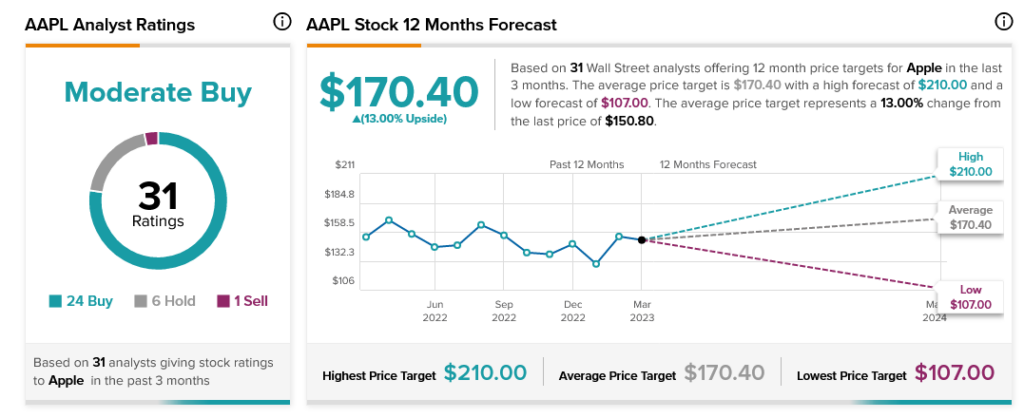

Things are looking good for Apple, and Wall Street is eager to point that out as well; AAPL stock is currently rated a Moderate Buy by analyst consensus. Furthermore, it offers 13% upside potential thanks to its average price target of $170.40 per share.