According to a Wall Street Journal report, the U.S. Supreme Court turned down an appeal by Apple (NASDAQ:AAPL) and Broadcom (NASDAQ:AVGO) to hear their arguments in a patent infringement case brought by Caltech (California Institute of Technology). This implies that these companies will need to cough up money for patent infringement.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Caltech sued Apple and Broadcom in 2016 for violating its patents over Wi-Fi chips made by Broadcom and used in Apple’s devices. Both companies were told to pay $1.1 billion to Caltech for patent infringement.

Apple was asked to pay $837 million in damages, while Broadcom would add $270 million. The companies appealed the judgment. The U.S. Court of Appeals upheld the jury’s findings in February last year but ordered a new trial to recalculate damages.

Now the latest setback from the Supreme Court implies that both of these companies cannot challenge the validity of the patents and only contest the amount they need to pay for patent infringement. Shares of both companies remained unfazed by this recent development.

Is Apple a Buy or Sell today?

Apple stock has gained about 43% year-to-date due to the ongoing strength in the Services segment and strong demand for its devices. Further, its aggressive share buybacks and dividend growth act as catalysts.

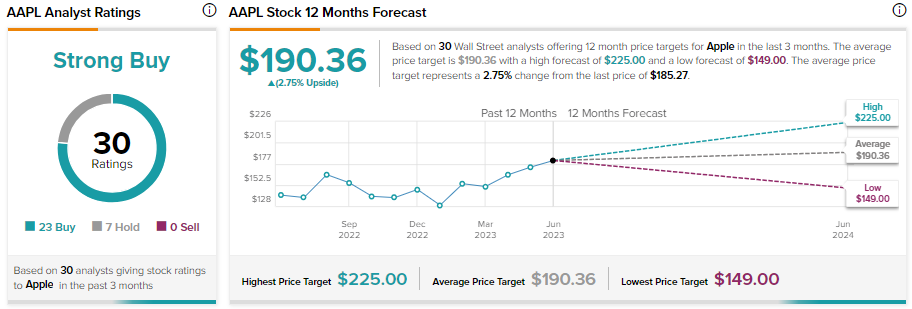

Wall Street remains upbeat about AAPL stock. It has received 23 Buy and seven Hold recommendations for a Strong Buy consensus. However, due to the recent price appreciation, analysts’ average price target of $190.36 implies 2.75% upside potential.

What is the Price Target for AVGO?

AVGO stock is up about 49% year-to-date, reflecting its growing market share in the chip industry and strong financial performance. It delivered $8.7 billion in revenue in Q2, while its EBITDA margin improved. The company generated $4.4 billion in free cash flow and expects its cash flows to remain strong in Q3 as well.

AVGO stock sports a Strong Buy consensus rating based on 14 Buy and two Hold recommendations. Analysts’ average price target of $867.6 implies 5.59% upside potential from current levels.