Airliner stock, American Airlines Group (NASDAQ: AAL) was down in pre-market trading even as the airline reported adjusted Q2 earnings of $1.92 per share as compared to earnings of $0.76 per share in the same period last year and above consensus estimates of $1.58 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The airliner posted record revenues of $14.1 billion in Q2, up by 4.7% year-over-year beating analysts’ estimates of $13.74 billion. AAL continued to pay down its debt in the second quarter, reducing it by $387 million.

The company stated in its press release that, “strengthening the balance sheet continues to be a top priority, and American is nearly two-thirds of the way to its goal of reducing total debt by $15 billion by the end of 2025. As of June 30, 2023, American had reduced its total debt by approximately $9.4 billion from peak levels in mid-2021.”

Looking forward, the management raised its FY23 adjusted earnings guidance in the range of $3.00 to $3.75 per diluted share while in the third quarter, it has projected earnings between $0.85 and $0.95 per share.

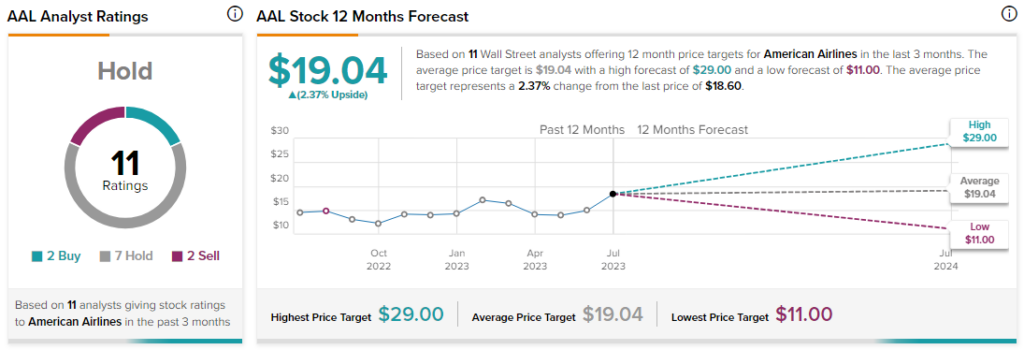

Analysts are sidelined about AAL stock with a Hold consensus rating based on two Buys, seven Holds, and two Sells.