Online retail giant Amazon (AMZN) has made great strides by branching off from the online retail market, particularly by breaking into streaming with Prime Video and cloud computing with Amazon Web Services. And now, Amazon is looking much more closely at quantum computing these days for its next big leg up. That news was a bit underwhelming to investors, but good enough, and shares ticked up fractionally in Friday afternoon’s trading.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Back in February, Amazon took its first steps into the quantum computing market by bringing out Ocelot, Amazon’s very own quantum chip. And, as such—noted Oskar Painter, Amazon Web Services’ director of quantum hardware—there is a “…strong business case for AWS or Amazon to get involved with quantum computing.” After all, Painter noted, it is “…very much in line with that sort of business model where you would have off-premise quantum computing resources that can be made accessible through the cloud.”

With reports from McKinsey suggesting that quantum computing could be worth $173 billion by 2040—or nearly double what AWS itself is worth today—it is small wonder that Amazon wants in on the action. And one of the biggest ways that Amazon is working to distinguish itself is in the use of “cat qubits.” Named for Schroedinger’s cat, the thought experiment that basically asserts a cat in a box is both alive and dead at the same time until you open the box and observe which state it actually is, a cat qubit design reduces errors and thus improves resource consumption for quantum processors.

Vulcan, The Touchy Feely Robot

In a move that suggests that Amazon’s plans to get rid of human warehouse workers is proceeding well on schedule, Amazon also rolled out a brand new warehouse robot. Known as Vulcan, it actually has a sense of touch. Well, not in the conventional sense, but most robots are, as Amazon’s director of applied science Aaron Parness noted, “numb and dumb.”

Vulcan, however, is different in that it can not only understand when it makes contact with an object, but how it makes contact as well. Vulcan is capable of handling objects within the one-square-foot fabric-covered pods where inventory is typically stored. It can measure how much force it is applying, and even understands when too much force is being applied, allowing it to back off accordingly.

Is Amazon a Good Long-Term Investment?

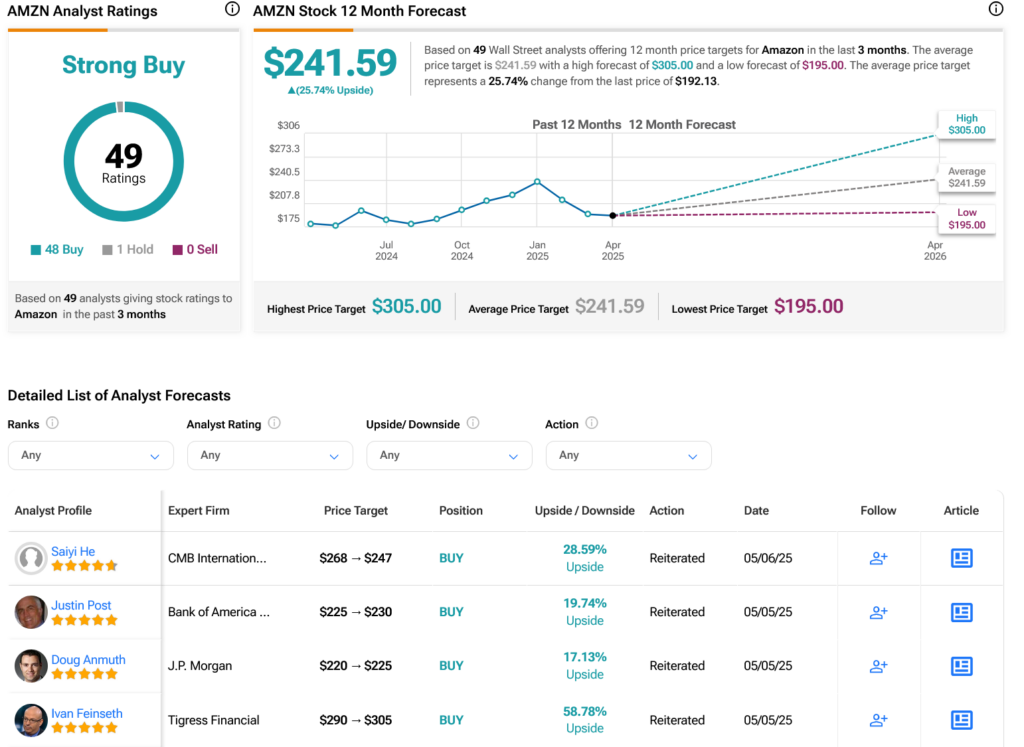

Turning to Wall Street, analysts have a Strong Buy consensus rating on AMZN stock based on 48 Buys and one Hold assigned in the past three months, as indicated by the graphic below. After a 2.46% rally in its share price over the past year, the average AMZN price target of $241.59 per share implies 25.74% upside potential.