The news isn’t looking great for Ford (NYSE:F), General Motors (NYSE:GM) and Stellantis (NYSE:STLA). Currently, UAW members are 97% in favor of a strike, should the need arise and no deal be reached by September 14. Yet all three stocks are up in Friday afternoon’s trading session. Are investors whistling past the graveyard? Or do they suspect a last-minute deal in the making?

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

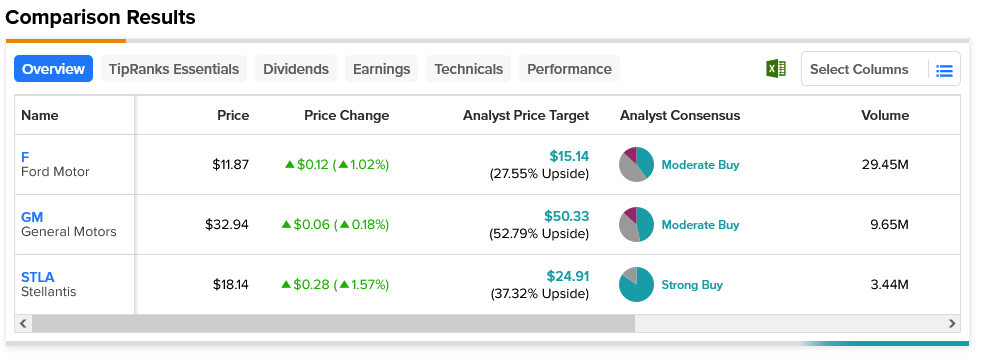

It’s true; all three major automakers are up. Granted, not much, and to different extents. Stellantis is leading the way at 1.57%, with Ford not far behind at 1.02% and GM up merely fractionally. Still, a win is a win, and all three automakers are winning right now. Talks are still going on, so the notion that a much bigger win could be pulled out at the last minute isn’t out of line. While some of the UAW’s proposals seem a mite ambitious—like the 46% raise over the next four years—the substantial profits seen at the corporate level do suggest at least some breathing room.

And the talks have certainly been wide-ranging. Currently, talks have even included the Ultium battery operations near Warren, Ohio, and the UAW is working to get the nine other plants in the U.S that GM, Stellantis and Ford are poised to bring in. This may or may not have much value; with dealers already turning away electric vehicle inventory over lack of buyers, those battery plants may not be open that much longer to make them worth including anyway.

All three automakers are indeed up, but that doesn’t mean each is an equal prospect. Stellantis is the only one on the list considered a Strong Buy by analysts, but its $24.91 average price target gives it only the second-highest upside potential at 37.32%. GM currently has the best upside, even as a Moderate Buy; its $50.33 average price target gives it a 52.79% upside potential.