The family vacation, both lionized and vilified, depending on who you talk to, is enjoying a bit of a renaissance. Lodging giant Airbnb (NASDAQ:ABNB) offered some perspective on its own connection to family travel, and it turns out it’s growing. Not fast enough, or large enough, to satisfy investors, though, as Airbnb lost nearly 2% at the time of writing.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The numbers Airbnb had to offer weren’t exactly bad. Family trips booked on Airbnb were actually up 10% against the same time last year, and families went to over 13,000 destinations in total. Most families turned to a two-bedroom or three-bedroom listing, and the variety of destinations surprised even Airbnb. Some destinations were familiar, like Pigeon Forge in Tennessee or Traverse City in Michigan. However, less-expected destinations like Cincinnati, Ohio, and even Saint Paul, Minnesota—near the Mall of America—showed up.

Yet, even as the numbers went up, there is an increasing number of Airbnb operators that may never list property therein again. This summer proved to be “unpredictable” by some reckonings, and with significantly more supply than demand, some are wondering if it’s worth the bother. It doesn’t help that many families are paring back travel thanks to inflation-related stresses on the budget. And with scammers also getting involved—the Better Business Bureau recently warned about one such scam—Airbnb’s abundant supply of destinations may soon be limited.

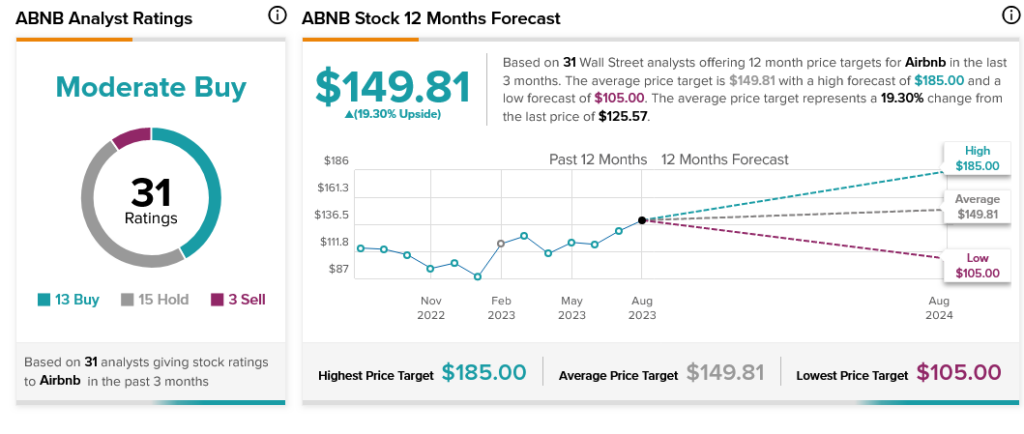

Analysts, however, are somewhat mixed on Airbnb’s future. With 13 Buy ratings, 15 Holds, and three Sells, Airbnb stock is considered a Moderate Buy by analyst consensus. Nevertheless, Airbnb stock offers investors 19.3% upside potential thanks to its average price target of $149.81.