Just recently, we got wind that satellite radio giant Sirius XM (NASDAQ:SIRI) was looking to pull in new and younger listeners to its platform. Did it work that well already? Because Sirius stock is up nearly 6% in the closing minutes of Wednesday’s trading session. As it turns out, it might have worked that well, or there may be a different explanation afoot.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The more likely explanation—but one that could still allow for Sirius’ push for the youth market—is a big new investment from none other than Berkshire Hathaway (NYSE:BRK.B). Berkshire Hathaway stepped in to the tune of around 9.7 million shares, which together had a market value of roughly $43.8 million. That’s based on a recently-filed 13F report from Berkshire Hathaway. While the earnings report Sirius posted wasn’t the best—it posted a win on earnings but a miss on revenue—it managed to do something few media properties could pull off in this macroeconomic environment: increase its advertising revenue against the same time in 2022.

New Channels May Draw Attention after All

Certainly, there’s some room for a potential victory here. Indeed, Sirius’ push to bring in younger listeners comes right at about the same time that it posted improvements in ad revenue. That combination suggests that, if it pulls in more listeners—especially more young listeners—it could go quite some way toward pulling in more advertisers and more cash with them. Indeed, Sirius launched several new channels recently. While some may not be much value for the youth market at all—like the new Dolly Parton channel around the release of her new album “Rockstar,”—others like Radio Monaco, DJ sets, and celebrity news, may fit the bill much better.

Is Sirius a Buy or Sell?

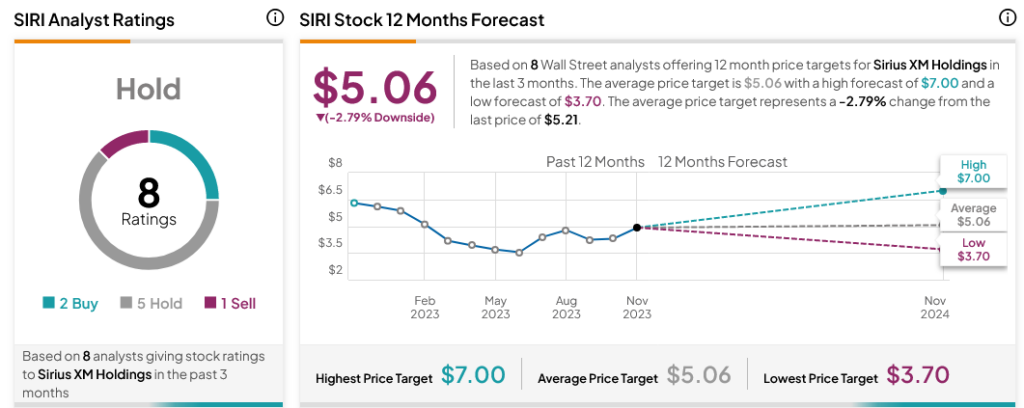

Turning to Wall Street, analysts have a Hold consensus rating on SIRI stock based on two Buys, five Holds and one Sell assigned in the past three months, as indicated by the graphic below. After a 18.38% loss in its share price over the past year, the average SIRI price target of $5.06 per share implies 2.79% downside risk.