We already knew that social media giant Meta Platforms (NASDAQ:META) was branching out. It’s brought out several advances in artificial intelligence and virtual reality that are making it increasingly a powerhouse in the field. But now, new reports suggest that Meta may have one more talent up its sleeve: chip design. This revelation was taken reasonably well by investors, who sent Meta shares up modestly in Thursday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The latest word suggests that Meta might be offering up its own chip foundry operations, as it’s building its own line of custom processors to address its growing roster of artificial intelligence options. The chips will go into production sometime this year and will be added to Meta data centers everywhere.

Further, the chips have been specifically designed to work in concert with other chips that Meta is buying directly from third parties, which should make their addition to data centers go about as smoothly as it can. Meta was previously seen buying chips from Nvidia (NASDAQ:NVDA) and AMD (NASDAQ:AMD), so this move may take some of that expense off the table going forward.

A Social Media Crossroads

When the Attorney General of New Mexico describes your primary business—and your website—as the “…single largest marketplace for pedophiles,” you know there are some serious issues afoot. In fact, you know there are the kind of issues afoot that might torpedo an entire line of business. So, it’s little surprise that, faced with an increasing number of lawsuits over pedophiles and teenagers’ self-image, among others, Meta is planning for a post-Facebook future.

Is Meta a Buy or Sell?

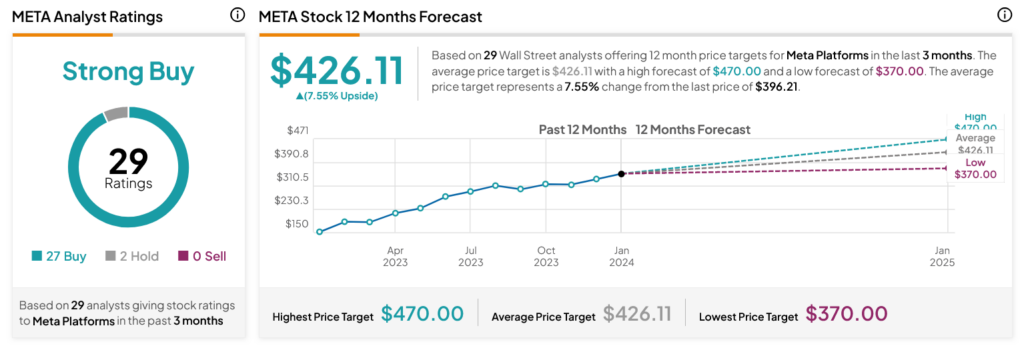

Turning to Wall Street, analysts have a Strong Buy consensus rating on META stock based on 27 Buys and two Holds assigned in the past three months, as indicated by the graphic below. After a 109.37% rally in its share price over the past year, the average META price target of $426.11 per share implies 7.55% upside potential.