Headquartered in Minnesota, PetVivo Holdings (PETV) licenses and commercializes medical devices and biomaterials to treat diseases in animals. Kush, which is the company’s key product, is used for treating osteoarthritis in companion animals. Additionally, PetVivo has 17 therapeutic devices in its product pipeline for veterinary as well as human clinical uses.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

According to the American Pet Products Association, the U.S. veterinary care market has grown at a CAGR of 4.8% between 2015 and 2019 to reach a size of $19 billion. PetVivo estimates that about 20 million owned dogs in the U.S. and the EU suffer from osteoarthritis, which makes canine osteoarthritis a $5 billion target market for the company (Assuming a selling price of $250 per canine unit).

PetVivo’s revenue for Fiscal Year 2021 was $12,579 versus $3,588 a year ago. The net loss of the company widened to $3.52 million in Fiscal Year 2021 from $2.08 million in Fiscal Year 2020. (See PetVivo stock chart on TipRanks)

PetVivo Risk Factors

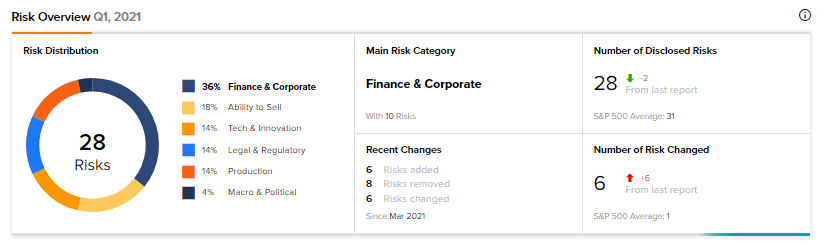

According to the new Tipranks Risk Factors tool, PetVivo’s main risk category is Finance & Corporate, which accounts for 36% of the total 28 risks identified for the stock. The next two major risk factor contributors are Ability to Sell and Tech & Innovation at 18% and 14%, respectively. Since March, the company has added six new risk factors and removed eight risk factors. Let us have a look at the newly added risk factors by the company.

PetVivo’s Articles of Incorporation, Bylaws, and Nevada law may discourage or prevent a takeover or change of ownership even if such a move would be beneficial to common stockholders.

The company’s stock has been volatile in the past, owing to a low public float, and if it gets deemed as ‘penny stock‘ again, it would be difficult for investors to exit their positions.

As with all healthcare companies that have multiple products in development and very few products on the market, PetVivo’s success depends on the clinical advancement of its products, and an adverse event in clinical stages can hamper its future prospects.

Another key risk is that PetVivo relies on third parties to manufacture raw materials for its Kush product and, in case of an adverse event, its ability to produce Kush products can be hampered.

Compared to a sector average Finance & Corporate risk factor of 41.5%, PetVivo’s is at 36%, indicating that owning the stock is less risky versus the broader sector. Shares are up 155.6% over the past year.

Check out the Risk Word Cloud feature from our Risk factor tool, which highlights the most common risk factor phrases from PetVivo’s most recent filing, along with the most used risk phrases.