Electric vehicle (EV) titan Tesla (NASDAQ:TSLA) has been on the ropes for weeks now. Tesla’s recent troubles, along with wider symptoms of distress in the market, make some wonder if there’s trouble ahead. One person doesn’t wonder, though, as evidenced by her eagerness to pick up more Tesla shares. That was news enough to give Tesla a bit of an uptick for the first time in days. So who’s the big Tesla buyer? No less than Cathie Wood.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Wood—whose ARK Innovation Fund (NYSEARCA:ARKK) has already lost a lot of ground—is doubling down on Tesla shares. ARK trade records found that the fund picked up more than 25,000 shares just on Tuesday. Over the last seven days, as Tesla share prices plunged, the fund steadily picked up more shares. Now, the fund has 133,194 shares of Tesla to its credit.

The recent plunge at Tesla has left plenty of investors shaken. Just ask anyone who’s sold Tesla stock recently. Yet, while some worry about Elon Musk’s capacity to focus on Tesla with Twitter going on, and others gnaw their nails over the state of the EV market, one factor only recently landed consideration: taxes. Not Tesla’s taxes so much as investors’ taxes. Selling a stock that’s been in free fall is a good way to realize capital losses. Those become tax deductions for better-performing stocks.

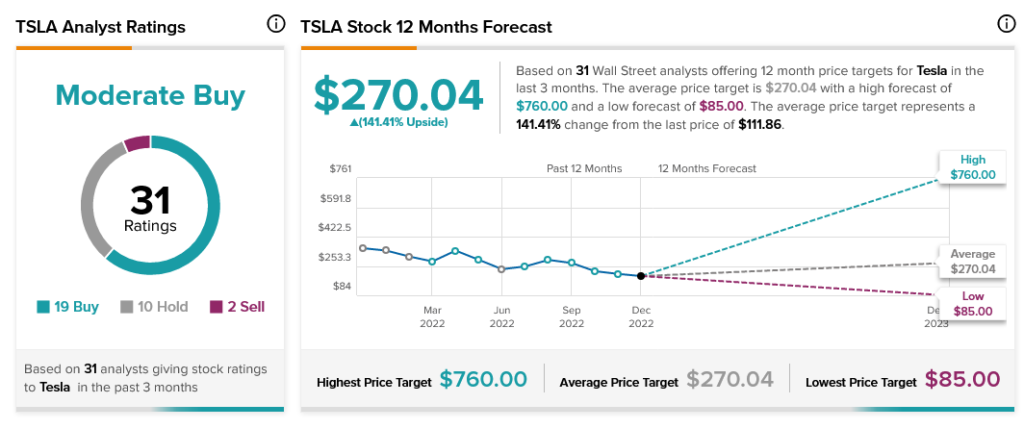

Currently, Tesla’s analyst consensus calls it a Moderate Buy. With an average price target of $270.04, the company has 141.41% upside potential.

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more.