Shares of analytical and clinical laboratory solutions provider Agilent (NYSE:A) are up by over 3.5% in the early session today after its first-quarter results surpassed estimates. Despite a year-over-year decline of 5.7%, revenue of $1.66 billion landed ahead of expectations by $70 million. In tandem, EPS of $1.29 outpaced consensus by $0.06.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

During the quarter, revenue in its Life Sciences and Applied Markets Group (LSAG) declined by 10% to $846 million. Further, Agilent’s revenue from the Diagnostics and Genomics Group (DGG) decreased by 6% to $407 million. On the other hand, revenue in its Crosslab Group (ACG) increased by 6% to $405 million.

Despite expecting market headwinds in the short term, Agilent is banking on its diversified offerings to drive growth. For Fiscal Year 2024, the company estimates revenue in the range of $6.71 billion to $6.81 billion. EPS for the year is seen landing between $5.44 and $5.55.

For the upcoming quarter, Agilent anticipates revenue in the range of $1.56 billion to $1.59 billion. EPS is expected in the range of $1.17 to $1.20. Notably, the outlook points to a decline of 9.1% to 7.4% in the company’s Q2 top line.

Is Agilent a Buy, Sell, or a Hold?

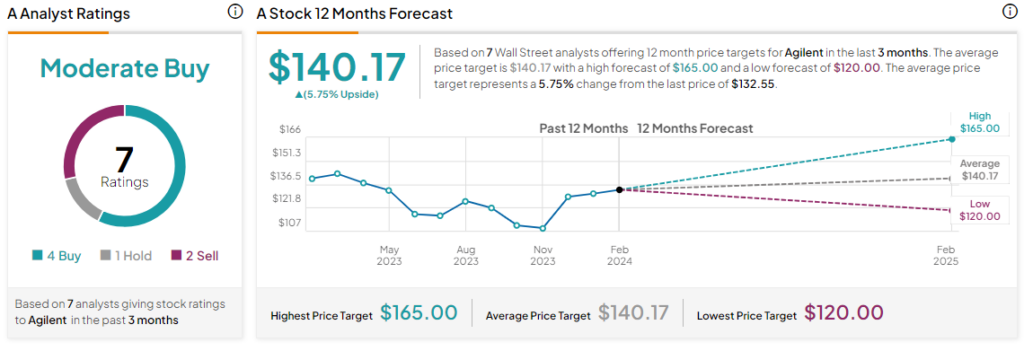

Agilent’s stock price has climbed by nearly 11% over the past six months. Overall, the Street has a Moderate Buy consensus rating on Agilent alongside an average price target of $140.17. However, analysts’ views on the stock could see a revision following its earnings report.

Read full Disclosure