New year predictions coming out any time in early January are pretty much as much a part of the new year as cold weather is if you’re north of the equator. Wedbush Securities is no different, announcing that a range of tech stocks, from Apple (NASDAQ:AAPL) to Microsoft (NASDAQ:MSFT) and several others in the field, are likely to push the Nasdaq in general up in a big way.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

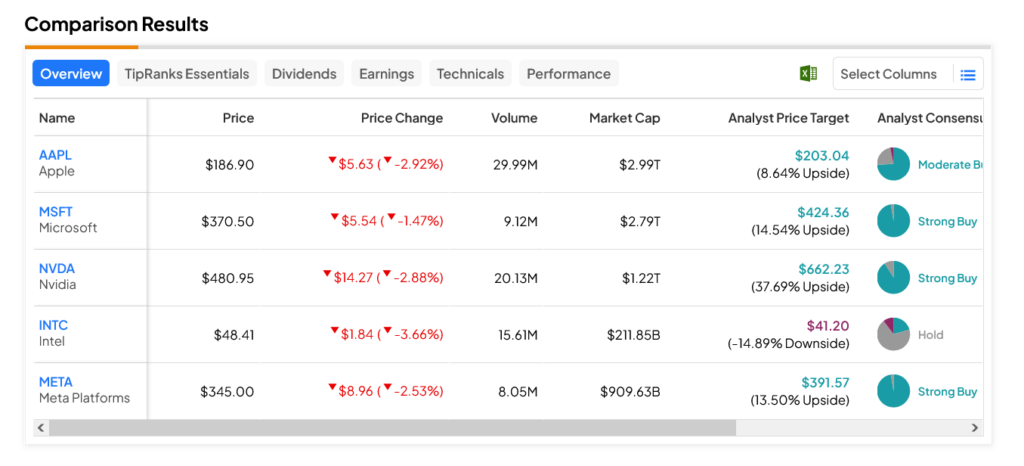

However, the market didn’t take those projections well; both Apple and Microsoft were down in Tuesday morning’s trading session, with Apple down nearly 3% and Microsoft down almost 1.5%. Meanwhile, Nvidia (NASDAQ:NVDA) was down almost 3%, Meta Platforms (NASDAQ:META) was down over 2.5%, and Intel (NASDAQ:INTC) was down over 3.5%.

The word from Dan Ives detailed that the tech stocks in question—though all down in today’s trading—would ultimately help to boost the Nasdaq overall, pushing the exchange to clear the 20,000 mark. Given that the Nasdaq right now is just under 15,000, that’s going to be a pretty significant gain. It’s not impossible, strictly speaking, but it’s not exactly a walkover prediction, either.

The biggest reason? A rising push toward monetization of artificial intelligence (AI). While AI was a huge part of 2023—mostly over what kind of impact it could have on people’s lives and careers—2024 will be the year investors look for those investments to start paying off.

Building a Case

AI is certainly going to be a big part of 2023, for better or worse. While there are signs of pushback at the regulatory level, there’s no real clue as yet just how far that will go. A recent executive order from the Biden Administration makes it clear that AI won’t be allowed to have its own way completely, to the point where some are accusing Biden of killing the golden goose that AI represents. Yet, even without AI, tech stocks made plenty of operational improvements as of late, scaling back operations, making layoffs, and advancing their companies so that stock gains seem that much likelier.

Which Tech Stocks are a Good Buy Right Now?

Turning to Wall Street, the far-and-away leader in the field is NVDA stock. With an average price target of $662.23, this Strong Buy-rated stock offers investors a 37.69% upside potential. Meanwhile, INTC stock is the clear laggard, as this Hold-rated stock offers investors a 14.89% downside risk on its average price target of $41.20.