Lithium may never be quite as valuable as gold, but it’s certainly seeing plenty of gains. That’s also true for lithium miner Livent (NYSE:LTHM), who managed to land a major sentiment change from Bank of America (NYSE:BAC). Livent stock surged in Wednesday afternoon trading on the strength of that shift and the reasoning behind it.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Bank of America, via analyst Steven Byrne, upgraded the position on Livent from “underperform” to Buy, two steps up in one single move. This briefly took Livent stock up over a high for the last two weeks. Byrne pointed out in a report that the lithium market, in general, should be “constructive” in the long term. Though, he noted volatility in demand lately has resulted in some “price softness” in the short term.

It’s something of a mixed bag in terms of predictions for the future. Some see a coming softness in the electric vehicle market. That, in turn, should lower the demand for lithium. However, others see an ongoing boom in the field that will keep demand brisk. India, for example, is already looking for international sources of both lithium and copper. It’s spiking in India, but supply issues are causing some of the demand imbalance. Meanwhile, a report from Fitch Solutions expects the boom to continue but begin to stabilize as supply chain issues start to resolve.

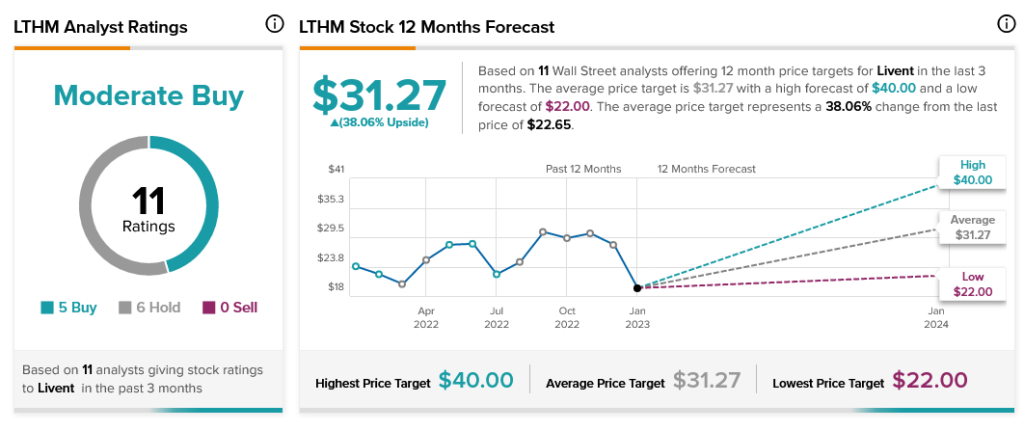

As for Livent, Wall Street is generally on its side. Analyst consensus calls Livent shares a Moderate Buy right now. Further, with an average price target of $31.27, Livent shares offer 38.06% upside potential.