TG Therapeutics (NASDAQ:TGTX), a leader in biotech stocks, had quite a volatile day. A loss following a slashed price target recovered, and then some, after a major insider buy stepped forward. In the final hours of Monday’s trading session, TG Therapeutics gained over 10%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Things weren’t looking good for TG Therapeutics for a while, as JPMorgan Chase cut its price target on TG Therapeutics from $34 to $22 per share. It did leave its “overweight” rating untouched, however, which reduced the sting of the losses. In fact, TG Therapeutics looked well on its way to recovering naturally when the news came down about a huge new insider buy. Michael Weiss, the company’s CEO, bought over $1 million in shares, giving him an extra 1% of the company and sending the stock up substantially.

All of this comes just days after TG Therapeutics entered into an agreement with Neuraxpharm Group that gave Neuraxpharm access to Briumvi, allowing the German group to sell the drug outside of the United States. The deal was valued at $645 million, at last report, which likely spurred the CEO’s plan to buy in. It certainly doesn’t hurt matters that Briumvi is a treatment for some forms of multiple sclerosis (MS), and is considered to be a “leading” treatment option.

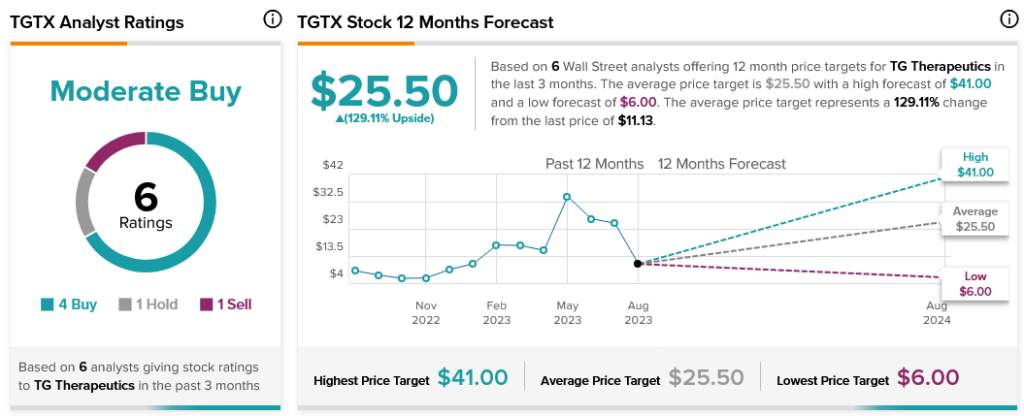

Analysts, meanwhile, are fairly solidly on TG Therapeutics’ side. With four Buy ratings, one Hold and one Sell, TG Therapeutics stock is considered a Moderate Buy. Further, even after today’s jump, TG Therapeutics stock still offers investors an upside potential of 129.11% thanks to its average price target of $25.50.